In order to attract quality candidates, companies often offer stock as part of their employee compensation packages. There are three main types they offer: incentive stock options (ISOs), non-qualified stock options (NSOs), and restricted stock units (RSUs). These mostly differ by how they’re taxed and by whether individuals need to purchase the shares.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Unlike with incentive stock options (ISOs), where you don’t pay taxes upon exercise, with NSOs you pay taxes both when you exercise the option (purchase shares) and sell those shares. This usually means you pay more taxes dealing with NSOs.

What is a stock option?

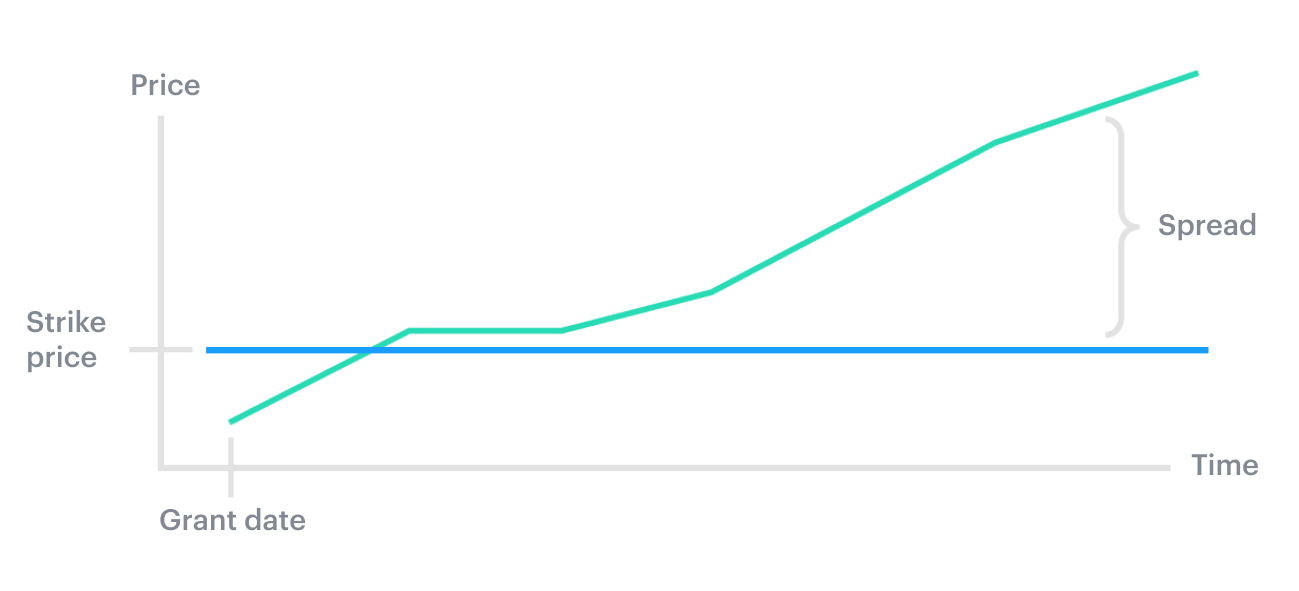

A stock option is the right to buy a set number of shares at a fixed price, often called the strike price, grant price, or exercise price. The price is usually determined by the fair market value, or whatever the shares are worth when you’re granted the options.

If the value of the share increases over time, you may make money on the difference between your fixed purchase price and your eventual sale price, or “the spread.”

Stock options are often used as a way to attract talent and incentivize employees to stay with a company. If employees exercise their options, they become shareholders in the company. There are two types: non-qualified stock options and incentive stock options. NSOs are more common than ISOs—probably because companies can take tax deductions when employees exercise their NSOs.

When can I exercise non-qualified stock options?

Usually, you can’t buy all of your shares right away and have to work for the company over time to be able to purchase your shares. This is called vesting. You can exercise your stock as soon as it is vested, but you’re never required to exercise.

Should you choose to exercise, you can either pay in cash or sell a portion of your shares to cover the cost of exercise (this is often called a “cashless” exercise). Check to see if your company allows cashless exercises.

If you leave your company, you’ll usually have a certain amount of time to exercise your vested NSOs. This period is called the “post-termination exercise” (PTE) period. If you don’t exercise your options before this period ends, you’ll lose your opportunity to purchase them.

How are non-qualified stock options taxed?

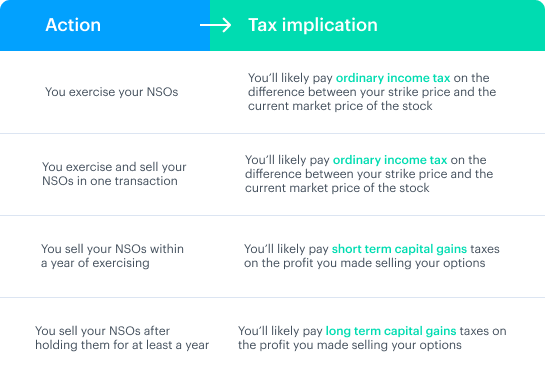

With NSOs, you pay taxes both when you exercise your options and when you sell your shares.

When you exercise

Your company will usually withhold ordinary income tax (which includes both payroll taxes and regular income taxes) on “the spread” when you exercise.

Remember: the spread is the value of the stock when you exercise minus the exercise price. For example, if you exercise 100 vested options at a grant price of $1 and the current value is $2, you’ll pay ordinary income tax on the $100 gain.

When you sell

After you exercise, you can either sell right away or hold onto your stock. If you sell right away, you will not experience any capital gain and therefore will not pay additional tax.

If you hold your stock for less than a year, when you eventually sell, you’ll pay short-term capital gains tax on any increase in value since the exercise date. You may be able to reduce your tax liability by holding your stock for at least a year before selling. That way, your gains are classified as long-term gains and you’ll pay taxes at the long-term capital gains tax rate, which is usually lower than the short-term capital gains tax rate.

To sum things up:

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.