When companies offer equity to employees, they usually offer stock options (like ISOs or NSOs) or restricted stock units (RSUs). You typically don’t get to choose which type of stock you receive; instead, what you receive depends on your role and the size, stage, and preferences of your company. But regardless of the type, you may get a chance to own a piece of the company, which motivates you to do your best work for the company.

An RSU is a promise from your employer to give you shares of the company’s stock (or the cash equivalent) on a future date if certain restrictions are met. Unlike with stock options, with RSUs you don’t have to pay anything to get the stock. Instead, you are usually only responsible for paying the applicable taxes when you receive the shares. And unlike RSAs, with RSUs you don’t get the shares until the restrictions are met.

How is RSU stock restricted?

In order for you to receive your RSUs, certain restrictions must be met. These restrictions are usually:

- Time-based (e.g. you must stay at the company for a certain amount of time)

- Milestone-based (e.g. your company must IPO or be acquired)

- A combination of the two (most RSUs issued at privately held companies have both a time-based and liquidation condition)

When you meet these restrictions, which should be outlined in your RSU grant, your RSUs vest and you receive your shares.

When can I sell my RSU stock?

If your company is public, you can usually sell your RSUs as soon as you meet the criteria and get your shares, as long as you comply with your company’s trading policy. With some companies, for example, you’re only allowed to trade stock during certain times of the year.

If your company is private, you’ll need to wait for a liquidity event (like an acquisition or IPO) or, if your company approves, find a willing buyer.

When thinking about whether to sell your RSUs, it’s a good idea to consider things like:

- How much you’ll be taxed

- Your company’s trading policy

- How you think the stock will perform in the future

- Your cash-flow needs

- How diverse you want your portfolio to be

What happens to my RSU stock if I leave the company?

If you leave your company, you generally get to keep your vested shares that are awarded as a result of the RSUs unless your time-vested shares expire before other conditions (like a liquidation event) are met. You’ll usually lose any shares that aren’t time-vested.

How are RSUs taxed?

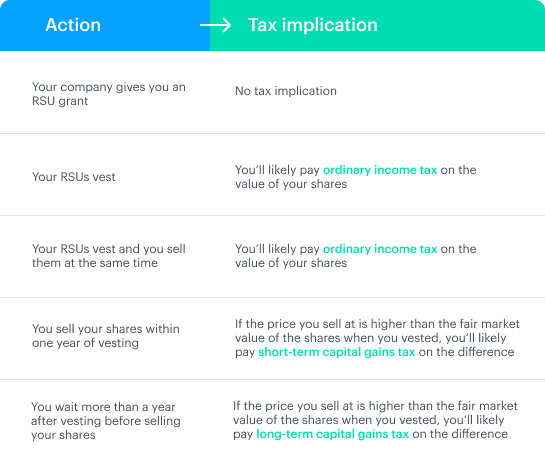

Unlike ISOs (where you usually don’t pay taxes until you sell your shares) and NSOs (where you pay taxes both when you purchase and sell your shares), with RSUs, you usually have to pay ordinary income tax on their market value when the shares are delivered, which is usually as soon as they vest. Your company may allow you to sell a portion of your vested shares to cover the taxes. Then, you can choose whether to hold the remaining shares or sell them right away.

When you sell, you may also need to pay capital gains tax on the increase between the price you sell at and the fair market value of the shares when you vested. How long you hold the shares usually determines whether you will pay short or long term capital gains tax. If you sell right after your shares vest, you probably won’t experience a gain and may not have to pay additional tax.

To summarize:

*DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is for informational purposes only and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.