Searching for a 409A provider can be a daunting task. As a new (or late) founder, knowing what to look for without the right guidance can be challenging. Here are some topics that we often address for prospects looking to find the right provider.

Independence

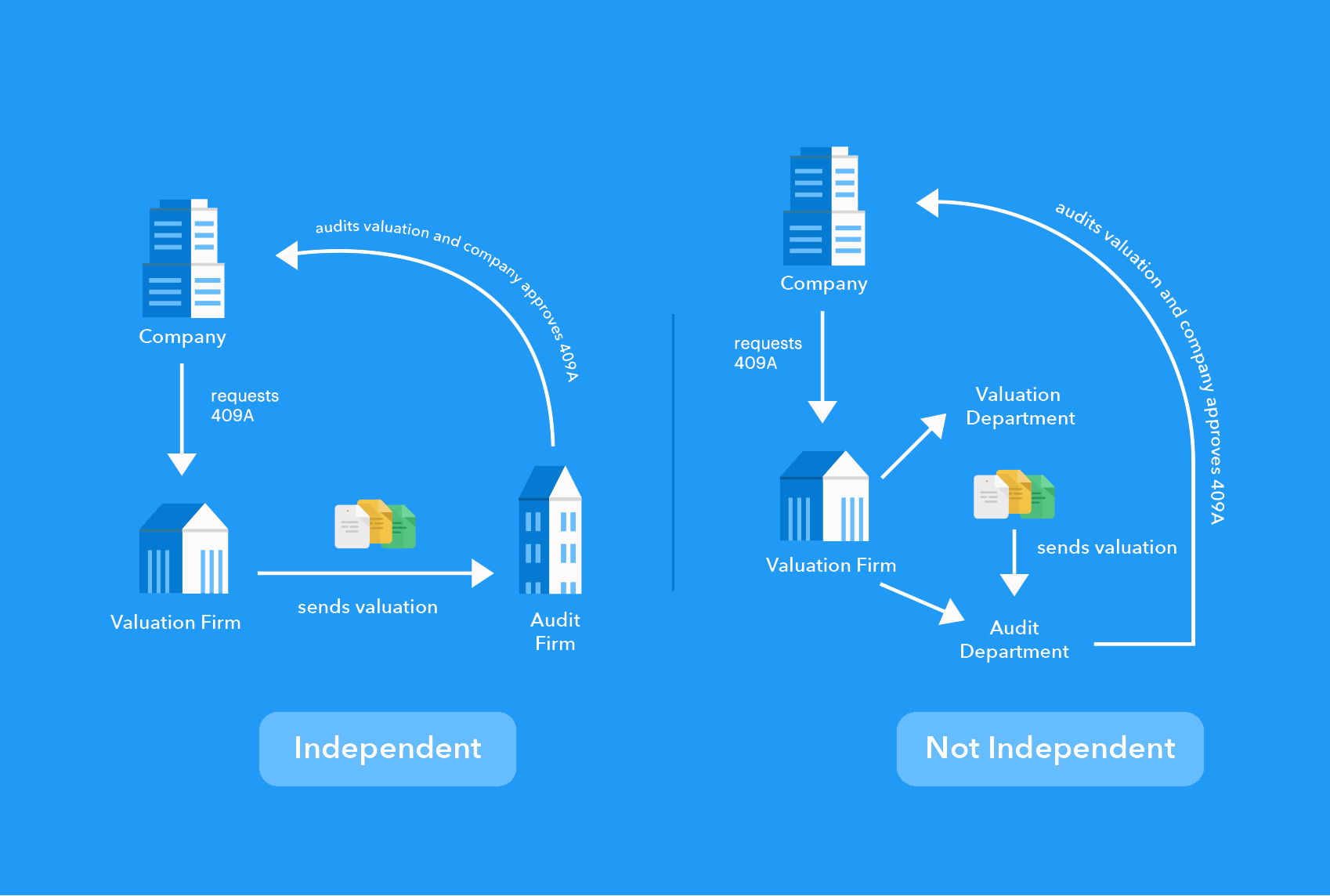

IRC 409A requires an independent 3rd party to value a company’s common stock. This simply means that a firm may not audit their own valuation.

Unfortunately, independence guidelines are often misconstrued. Independence standards are fairly broad and designed to address blatant fraud. They are primarily geared toward the accounting industry, not the valuation provider. These guidelines limit accounting firms to performing either stock option expensing and valuations. Accounting firms determine the fair value for common stock which is used as a basis for the valuation. This creates a conflict of interest if they were to enter the valuations industry, as the accounting firm could artificially inflate the fair value to create a higher valuation.

To alleviate any hesitation you need to be confident in the integrity of your valuations provider. One way to do this is by voicing your concerns right off the bat. A reputable provider should be able to seamlessly answer questions about independence and data integrity.

Carta chose to separate their valuation department to address this concern. We created Carta Securities, LLC to be distinctly different from Carta’s primary business. The LLC operates independently to mitigate any hesitance clients may have. It’s also valuable to remember that compensation should never affect your provider’s decision on the value of your common stock. The analyst examining your financials and performing the valuation should be a different person than the account manager discussing payment. This separation adds a level of objectivity that is key.

Understanding the company

Be sure to find a provider that is committed to learning about the details of your company and asks lots of clarifying questions. As an appraiser, having an in-depth understanding of the financial health of the company is vital for a reputable valuation.

At Carta, we require our analysts to book a 15-minute kick-off call with the client. Your analyst should understand your financials, validate the cap table, and talk methodology. The goal is to get a holistic picture of the financial past, present, and future of your company. This information will help the analyst select the best and most representative inputs for the valuation.

Passing an audit

Regardless of the stage of a company, an audit looms like a rain cloud. The most important requirement of any valuations provider is that they will carry you through and help you pass the audit. Often it can be tough to gauge who will provide you with the support needed to answer the difficult questions that will be asked during the process. Look for an appraiser that has worked closely with a variety of audit firms and is familiar with the type of questions that they might ask.

Time and cost

Ultimately, selecting a valuation firm can come down to time and cost. It can be difficult to find a firm that will provide a quality valuation within the price and time restrictions of an early startup. Low turnaround time can lead to a rushed report that may not adhere to the accounting and tax guidelines set by the IRS. Low cost can indicate a purely software-based 409A opinion that diminishes the accuracy. A well-balanced report uses the power of software complemented by the industry knowledge of an analyst.