Video: Panel discussion from The Future of Liquidity 2020

At our second Future of Liquidity event, we discussed recent trends in liquidity and their potential impact on private companies and venture portfolios.

subscribe

Stay up to date with monthly blog highlights

At our second Future of Liquidity event, we discussed recent trends in liquidity and their potential impact on private companies and venture portfolios.

In the world of fundraising, it’s not uncommon for investors and VC firms to craft term sheets that benefit themselves. For founders, knowing whether you’ve received a “clean” term sheet can be confusing.

As your company grows, you will inevitably be faced with a big question: Should you share your cap table with your investors? And if so, how much should you share?

Learn how to run an effective board meeting and download our free board meeting deck template.

Take-home pay is only part of the story. Women also face a huge gender gap in both startup funding and equity.

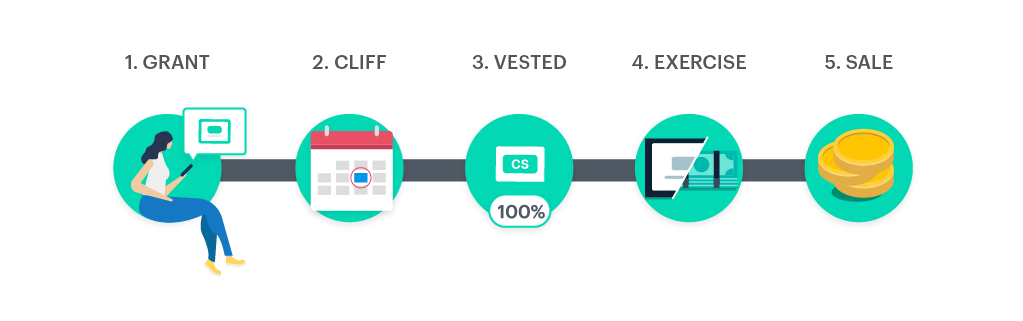

Learn the basics of equity, how to distribute equity to early employees, and what a cap table is.

When a private company exits, who gets paid what (and when) is primarily dictated by the following liquidation rights and preferences.

A conversation with Mutiny co-founder and CEO, Jaleh Rezaei about fundraising and how she got to a cap table that’s 50% women investors.

There are a lot of misconceptions causing companies to hold back from embracing liquidity. Here, we dispel the most common liquidity myths.

Subscribe