Fundraising for your company: convertibles and SAFEs vs. priced rounds

Three common fundraising options for early-stage companies are convertible notes, SAFEs, and priced rounds. Learn more about how each work.

subscribe

Stay up to date with monthly blog highlights

Three common fundraising options for early-stage companies are convertible notes, SAFEs, and priced rounds. Learn more about how each work.

Down rounds aren’t great, but they don’t mean doom and gloom either. Here’s how founders should approach them.

With unemployment skyrocketing, it’s more important than ever to try to help laid-off employees who have been faithfully working for you for years. Here’s what you need to know before extending your PTE window and how to do it.

We are working with Coastal Community Bank to build, test, and optimize a simplified application for startups on the Carta platform.

If you’re considering incorporating as an LLC, keep reading to learn more about the benefits, types, and equity options to see what makes the most sense for you.

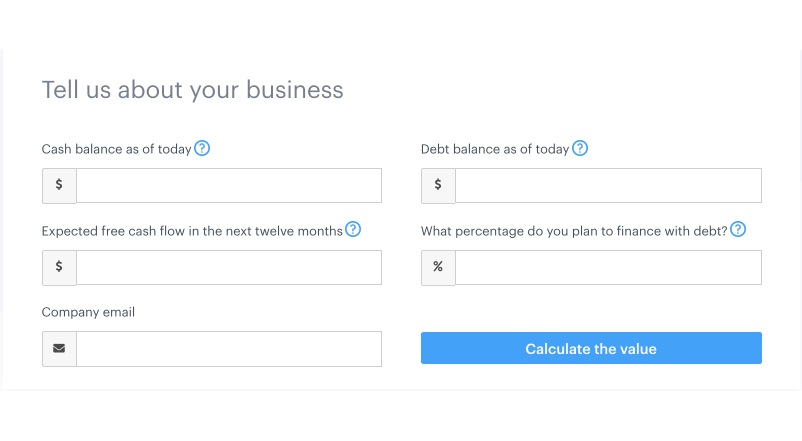

We created a simple tool for private companies to understand the value of their business.

The US government has recently acted to provide financial support to small businesses. We hope this guide helps company leaders understand what this looks like and how to access the programs.

Learn why asset impairement valuations are important, what impaired valuations will look like, how to approach them, and more.

We’ve compiled a list of tools and resources to help businesses and investors as they navigate this challenging COVID-19 crisis.

Subscribe