Mischa Vaughn

Growth and innovation: a Q&A with Andy Johns of Unusual Ventures

Andy Johns talks about building a venture firm with principles, growth hacking vs. product market fit, and what it’s like to turn from an operator into an investor.

How NLVC manages funds and works with LPs in China and the US

A discussion with Jeffrey Lee, Managing Director and CFO of NLVC about what it’s like to successfully manage funds across multiple geographies.

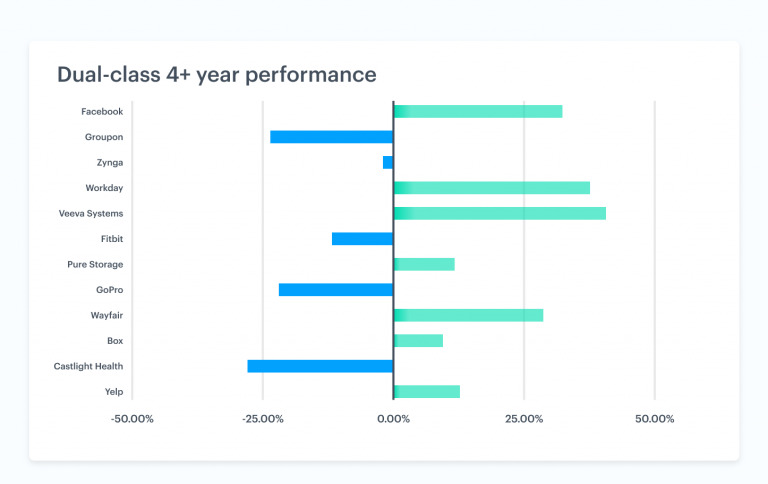

How dual-class companies and single-class companies compare

We look at how dual-class and single-class share structure affects company valuation and market performance.

Liquidity myths

There are a lot of misconceptions causing companies to hold back from embracing liquidity. Here, we dispel the most common liquidity myths.

SaaS company valuations, metrics, and IPOs: An interview with Alex Clayton of Spark Capital

We caught up with former banker and current investor Alex Clayton to ask him some questions about metrics, high valuations, and what it takes for companies to go public.

How a clean cap table helps you with an acquisition: Interview with MapAnything’s CFO

During MapAnything’s acquisition in 2019, Carta proved to be a valuable tool that sped along the due diligence process.

What to do before you raise a round

Founders and CFOs: here’s what you need to do before raising your next round and how Carta can help.

What happens to equity when a company is acquired?

If you’re at a company that has potential to be acquired, learn how an acquisistion could affect your equity.