What are employee stock options?

Stock options aren’t actual shares—they’re the opportunity to exercise (purchase) a certain amount of company shares at an agreed-upon price. Learn more.

Stock options aren’t actual shares—they’re the opportunity to exercise (purchase) a certain amount of company shares at an agreed-upon price. Learn more.

Exercising stock options means purchasing shares of the issuer’s common stock at the set price defined in your option grant.

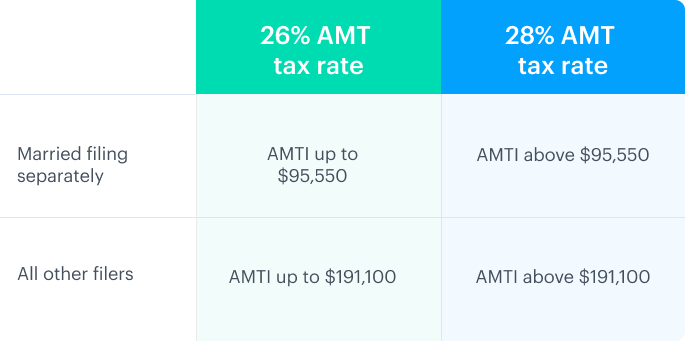

The alternative minimum tax (AMT) is a different way of calculating your tax obligation. Learn if you’re more prone to paying it, how to calculate it, how you may be able to minimize it, and more.

Download our sample 409A report to see what a complete 409A report looks like and help guide your evaluation of 409A providers.

To encourage employees to stay with a company longer, employees have to earn the right to purchase their shares over time. This is called vesting.

An RSU is a promise from your employer to give you shares of the company’s stock (or the cash equivalent) on a future date if certain restrictions are met. Learn more about this type of restricted stock.

ISOs are a type of stock option that qualifies for special tax treatment. Unlike other types of options, you usually don’t have to pay taxes when you exercise (buy) ISOs. Plus, you may be able to pay a lower tax rate if you meet certain requirements. Here’s what you need to know.

Non-qualified stock options (NSOs) are a type of stock option that does not qualify for favorable tax treatment for the employee. Learn more about when you can exercise (buy) your shares, when you can sell them, and how they’re taxed.

Subscribe