Jenna Lee

How Harlem Capital invests in diversity

Harlem Capital is aiming to invest in 1,000 diverse founders in 20 years. We sat down with cofounders Jarrid and Henri to hear their story and what they’ve learned so far.

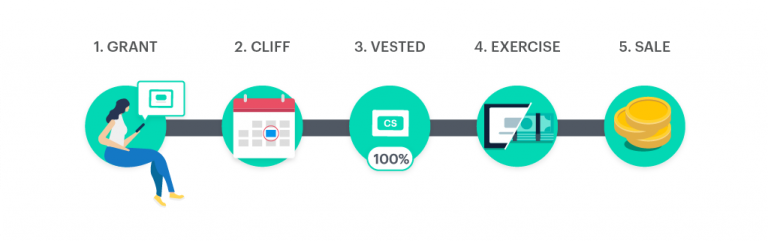

What to know about equity when you leave a company

If you’re leaving your company, you probably have a lot on your mind. But between finishing up projects, exchanging contact info with coworkers, and figuring out health insurance coverage, don’t forget to think about your equity. Here’s what you need to know.

What is a tender offer?

A tender offer is a structured, company-sponsored liquidity event that typically allows multiple sellers to tender their shares either to an investor or back to the company. In other words, it’s a potential way for you to sell some of your shares while your company is still private. Learn more.

What is an employee stock purchase plan (ESPP)?

An employee stock purchase plan (ESPP) is a program public companies can offer that allows you to buy shares of company stock—usually at a discounted rate. Here’s what you need to know before participating:

How to create a cap table (free cap table template)

There’s no standard cap table format, and there are multiple ways to create one. We’ll walk you through a few ways to get started and include a free cap table template you can download.

How are stock options taxed?

Here’s what you need to know and prepare for if you exercised and/or sold stock options this year.

How to value a job offer from a public company vs. a private company

You can’t compare job offers with public equity vs private equity apples to apples. Learn how to think about and compare them.

Equity basics for founders

Learn the basics of equity, how to distribute equity to early employees, and what a cap table is.