SCENARIO MODELING & PLANNING

Plan for the future with scenario modeling

Carta’s scenario modeling software streamlines sensitivity and breakpoint analysis, payout and dilution modeling, and pro forma cap tables so investors and companies can easily understand the impacts of fundraising and exits.

SCENARIO MODELING

Comprehensive modeling tools for your company or fund

Auditor tested

Breakpoint analysis results have been independently confirmed by top audit firms.

Understand your options

Your cap table data is already in Carta, so you can easily iterate on exit scenarios in a few clicks.

Robust reports

Look several steps ahead by combining financing round and waterfall modeling.

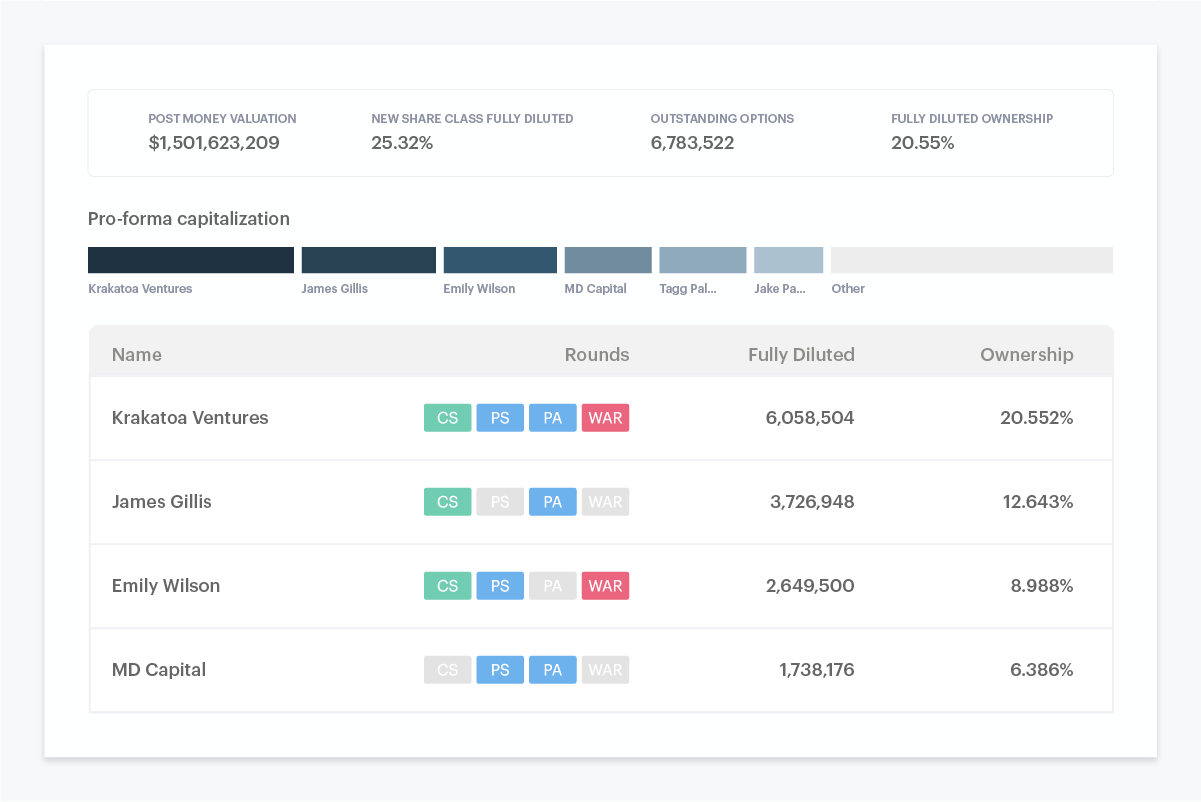

FINANCING ROUND MODELING

Create pro forma cap tables in seconds

Understand how raising a round will impact shareholders

Leverage data already in Carta to build pro forma cap tables. If you already have a term sheet, you can plug in your precise terms to see their effect.

See dilution impact without creating your own models

Use our advanced scenario modeling tools to understand your potential post-money dilution, valuation, and outstanding options.

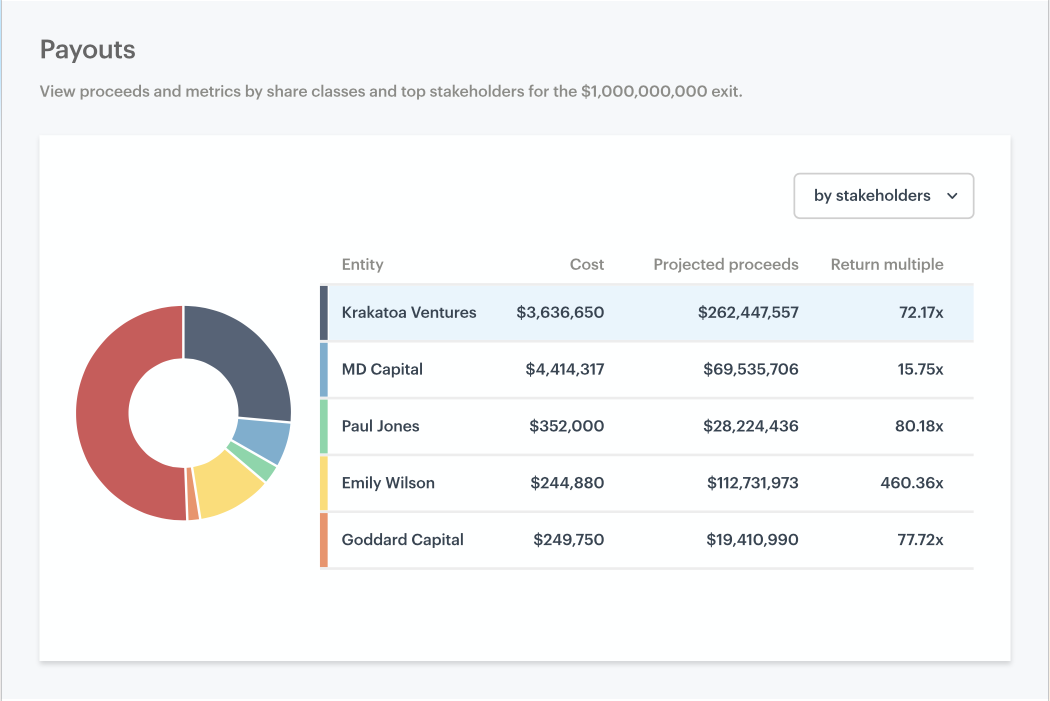

WATERFALL MODELING

See payouts for possible exit values

Understand payouts by share class

Simply input your exit value and non-convertible debt, and instantly determine the amount each share class will receive. For investors, you’ll also understand the payout for each fund.

Understand the impact of fundraising now and exiting later

If you have a complex scenario, our tools can handle it. Our scenario modeling reports work together, so you can run a waterfall model on a pro-forma cap table (mind blown).

join carta

Plan for the future with scenario modeling tools

Scenario modeling is included in Growth & Scale plans. Learn more about our plans and pricing.