LIQUIDITY EVENTS & TENDER OFFERS

Run liquidity events on Carta

Why Carta liquidity?

Trusted to transact for private companies

Automatic cap table updates

Cap table automatically updates and reconciles after the transaction

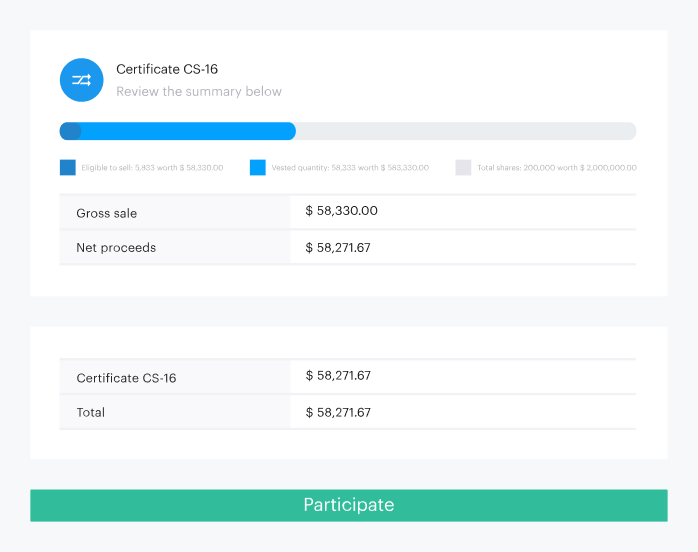

Simple participant experience

Participants review offers, sign docs, and transact all through Carta.

No onboarding required

Reduce the administrative costs related to secondary transactions.

CARTA PLATFORM

Set up and track liquidity events

Simple set up

Automatic cap table updates

When you run a liquidity event on Carta, your cap table automatically updates as soon as the transaction settles. With traditional providers, manual entry is required to update your cap table and process paper certificates.

PARTICIPANT EXPERIENCE

Help your employees unlock value

Shareholder-friendly experience

Liquidity as an employee perk

LIQUIDITY IS HERE

Unlock the value of ownership with CartaX

Carta Blog

Read more about the future of equity compensation

State of Private Markets: Q2 2022

Venture capital is in a slowdown, but not a freefall. For the past two quarters, the number of rounds and the amount of cash raised

What is Regulation D?

Regulation D allows private funds and companies to fundraise without registering the offering with the SEC.

RSAs vs. RSUs

Restricted stock awards (RSAs) and restricted stock units (RSUs) are two types of restricted stock equity awards. Learn the differences between RSAs and RSUs.