CARTA ASC 718

Stock-based compensation reporting

Get expense and disclosure reports in real-time, as mandated by ASC 718. Carta makes it easy to stay audit-ready and GAAP compliant and streamlines all information in one platform.

Why Carta?

GAAP-compliant and audit-ready reports

Integrated with your cap table

With your company’s cap table on Carta, expenses accrue automatically as you issue equity.

Scale your reporting

Stay audit-ready and comply with U.S. GAAP principles as your company grows.

Automated and efficient

Calculate your stock-based compensation expenses quickly and at a fraction of the cost.

or contact sales at 1-833-403-5468

CARTA ASC 718

Automated reporting

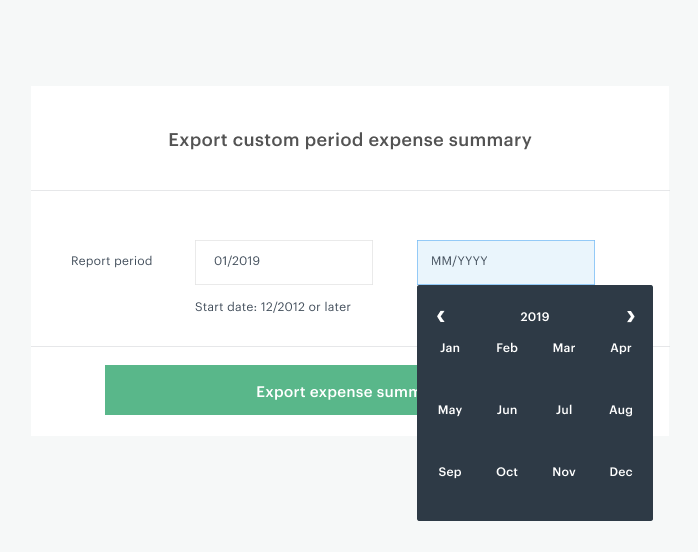

Audit-ready expense reporting at your fingertips

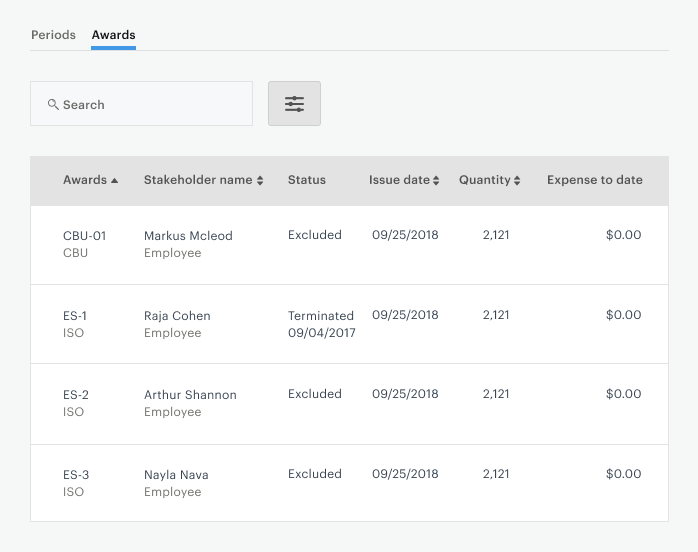

Get detailed reports broken out by reward without manual data entry. Export options monthly, quarterly, or annually with just a few clicks.

Scale your financial reporting

As your company grows, your financial reporting gets more and more complex. Carta’s expense reporting supports stock splits, grant re-pricings, and more.

GAAP-COMPLIANT AND AUDIT READY

Compliance made easy

Keep your company’s finances in good standing

As you begin working with auditors, automated stock-based expense reporting can help your company stay ready for audits and comply with U.S. GAAP principles with less effort. Carta provides clean, convenient expense accounting before an audit.

from the blog

What is ASC 718?

Learn more about what ASC 718 entails, and when you should start expensing employee options.

join carta

Start reporting stock-based compensation with Carta today

ASC 718 reporting is included with Carta’s Scale plan. Learn more about our plans and pricing.