CARTA FOR LAW FIRMS

Updated on September 1, 2020

May 2020 Update

WHAT’S NEW

New partner tiers

Last month we introduced a few important changes to our Law Firm Partner Program with new partner tiers, based on feedback from our latest Partner Survey.

Law firms will be assigned tiers based on the total number of new active referrals made by your firm in the prior calendar year. The more your firm grows with Carta, the more benefits you unlock for your clients.

For firms that were members of our partner program before April 16, tiering will go into effect on January 1, 2021. To learn more about how this affects you and your firm, check out our FAQs.

Product updates

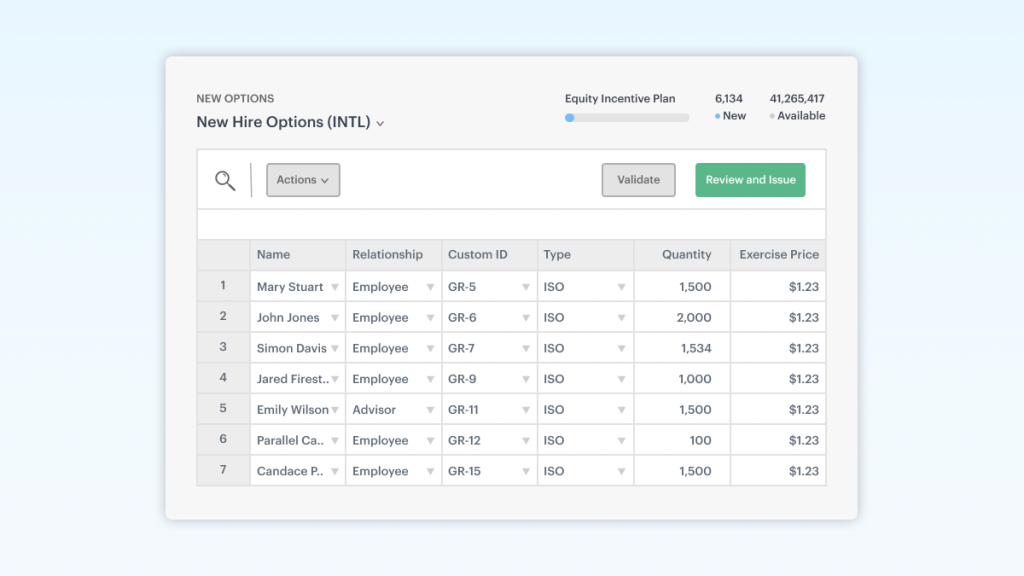

New drafts workflow

We’re rolling out a new and improved drafting and issuance workflow. This includes an in-app spreadsheet to better support large data sets, as well as advanced validations to improve data accuracy and completeness of each security.

LEARN MORE >

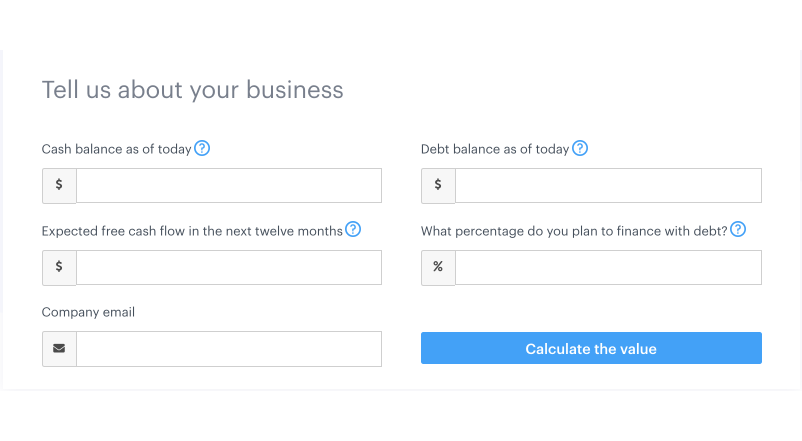

Valuation tool

We created a tool for private, profitable companies to understand the value of their business. It uses the capitalized cash flow method, which requires discounting the company’s future cash flows at a calculated rate.

LEARN MORE >

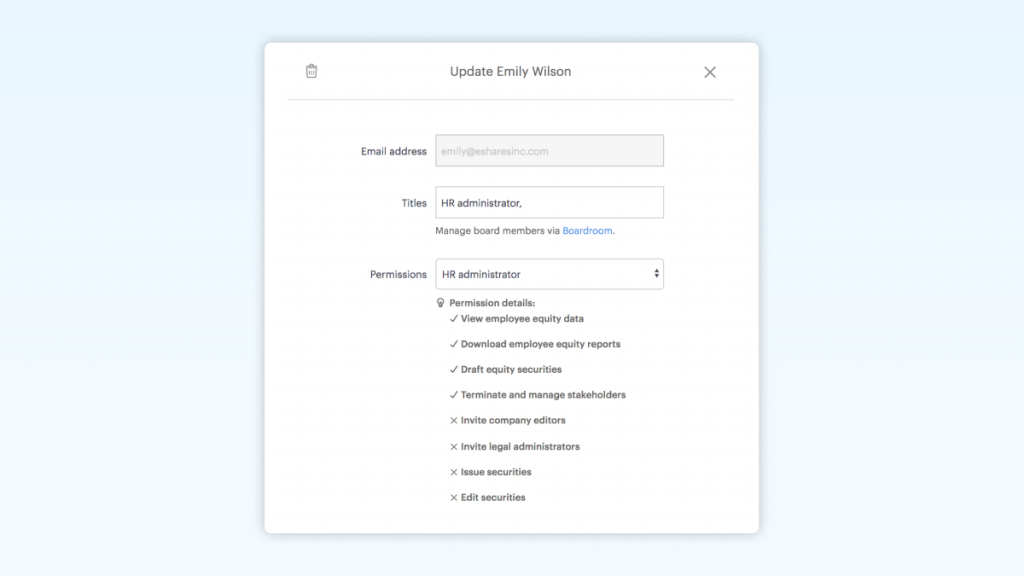

HR permissions

Allow companies to set different levels of access for HR personnel and better control who has full cap table access. HR personnel can still perform tasks like drafting new grants and terminating grants upon an employee’s exit.

LEARN MORE >

Other updates

AWS Activate credits for your clients

Carta has partnered with AWS to offer Carta customers AWS Activate credits to help grow and scale their businesses.

- Carta Launch customers can apply to redeem up to $5,000 in AWS Activate credits.

- Carta customers on any paid plan that have raised over $1 million and are a Series A company (or earlier) can apply to redeem up to $100,000 in AWS Activate credits.

Terms and conditions apply.

Guidance for Down Market Actions on Carta

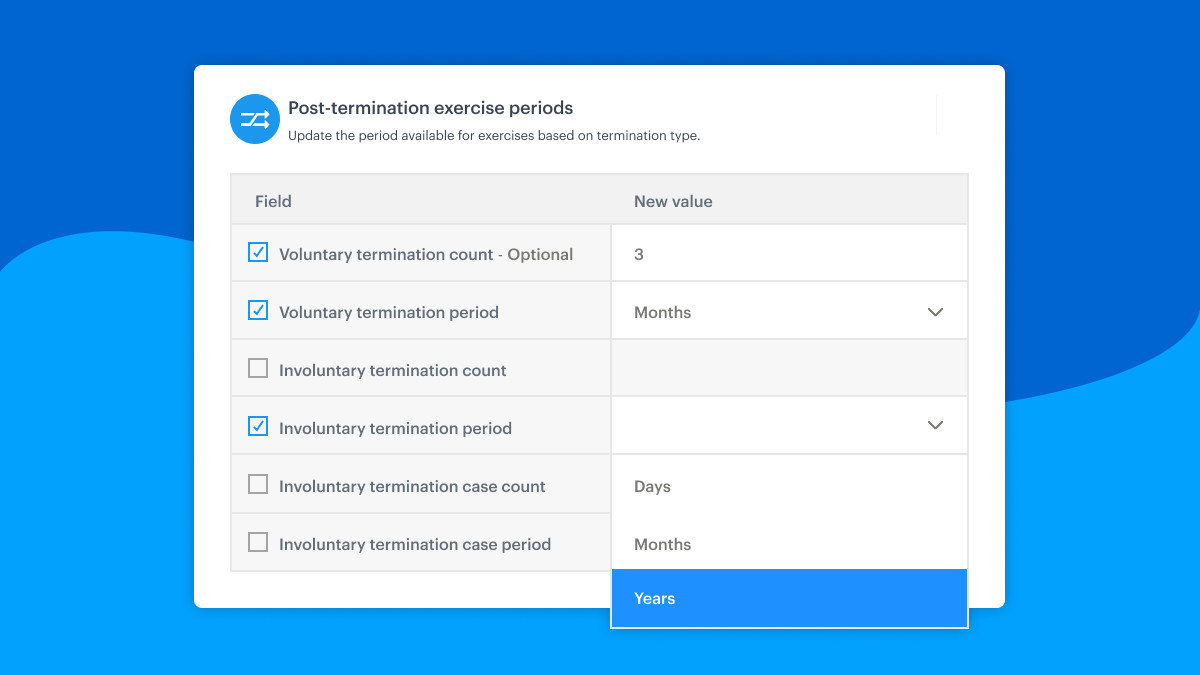

How to help extend your client’s PTE window

With unemployment skyrocketing, many companies are trying to help laid-off employees who have been faithfully working for them for years by extending their PTE window.

Find out how to do extend PTE windows in Carta.

Liquidity and CartaX

As a leading provider of liquidity solutions, Carta has supported over 100 tender offers through our integrated platform. We continue to innovate in the secondary space and are excited to announce the upcoming launch of CartaX, a new platform offering tailored liquidity solutions for private companies, operated by our affiliate Carta Capital Markets, LLC.

Pending regulatory approval, CartaX will be the first vertically integrated market ecosystem for private securities that offers price discovery and matches buyers and sellers using an auction-based methodology.

CartaX will enable private companies to offer programmatic, on-demand liquidity to the shareholders and investors of their choice with ease. CartaX will be fully integrated with Carta’s cap table management platform, providing management with visibility and transparency while reducing administrative burdens.

To learn more about CartaX, or to inquire about tender offer support for your clients, please contact us at info@cartacapitalmarkets.com.

Hot off the press

EVENTS

Future of liquidity recording

We held our second Future of Liquidity event in early March in New York City. In partnership with Company, a NYC-based startup accelerator, over 120 lawyers, investors, founders and CFOs came together to discuss recent trends in liquidity and their potential impact on private companies and venture portfolios. WATCH THE RECORDING >

FROM THE BLOG

How Carta does Enterprise Valuations

Private companies have increased regulatory and compliance needs as they grow. That’s why we’ve built a team with unique industry expertise and modern tools and resources to provide our customers with an unrivaled experience. READ THE POST >

CUSTOMER STORIES

Case study: Brickell Biotech

See how Brickell Biotech manages their equity from private to public on Carta.

READ THE CASE STUDY >

RESOURCES

IPO with Carta

Carta helps companies make the transition from private to public, from maintaining your cap table and running quarterly

409A valuations to supporting your stock splits and managing your equity plan.

WHERE TO FIND US