CARTA FOR LAW FIRMS

March 2021 Update

WHAT’S NEW

Founders and Counsel can now do more with Carta Launch

Carta Launch goes beyond cap table management to help early stage founders and their counsel with new early-stage fundraising tools: model SAFEs and Convertible Notes; benchmark with live market data for pre-seed, seed, and Series A fundraises; and generate and manage new SAFEs with the terms you want. Get clients onboarded to their free Carta Launch account from the ‘Companies’ tab of your Carta account.

New Features you’ll find in the free Carta Launch plan:

- Dilution modeling (SAFEs & notes)

- SAFE financings

- Live Market Data (seed, pre-seed, Series A)

- Cap table management

- Electronic securities & exercising

- HRIS & payroll integration

- Data Room

- Board consents

- Standard reporting

Important updates

Always stay up to date on new product changes with Carta’s Release Notes.

Liquidity is here! Carta recently completed its first liquidity transaction on CartaX

More than 1400 executed orders from 414 market participants, at a roughly 2x implied value premium to our Series F. We share more details on the transaction in our recently published case study.

CartaX is the liquidity solution for private companies seeking:

- To attract, retain and reward talent

- To return value to shareholders and investors

- A market-based price discovery process

- More efficient bilateral secondary transactions

If you’d like to learn more about how CartaX can work with you and your clients to set up recurring liquidity programs, or if you have questions about tender offer support, please contact us at partners@carta.com.

International Exercising: Submit and settle exercises with Carta

Non-US option holders at US private companies will now be able to initiate and pay for option exercises through Carta (must be enabled on client’s account). Take a look at the release notes article and don’t forget to subscribe to release notes to stay up-to-date on Carta’s product changes.

More product updates from release notes:

83(b) election initiative: to simplify the process & ask the IRS to temporarily enable electronic election forms

We think filing an 83(b) election should be easier and are asking the IRS to help. To support this effort, Carta has partnered with Perkins Coie to build a broad coalition consisting of dozens of leading technology law firms, accelerators, venture capital investors, and industry associations.

Learn more here and lend your support by emailing policy@carta.com.

Other updates

Total Comp product for companies (BETA)

Carta recently launched a beta version of our Total Comp product for companies. Carta Total Comp makes it easy for teams to:

- Design offers that are both fair and competitive

- Benchmark your team using the most robust equity data set in the market

- Understand the cash and equity impact of growing and retaining your team

We are currently qualifying customers for our Beta program. If you think your clients may be interested, please feel free to reach out to partners@carta.com.

Carta for Private Equity & LLCs

We have now fully launched our Carta for Private Equity product, which modified our core cap table product to support the complex capital structures found in private equity portfolios, such as multi-entity structures, profits interests, and other complex structures. Two of the top five largest private equity firms in the world now use Carta for Private Equity to manage their portfolio company cap tables. To learn more about how we’re working with LLCs and Private Equity backed companies, contact us at partners@carta.com.

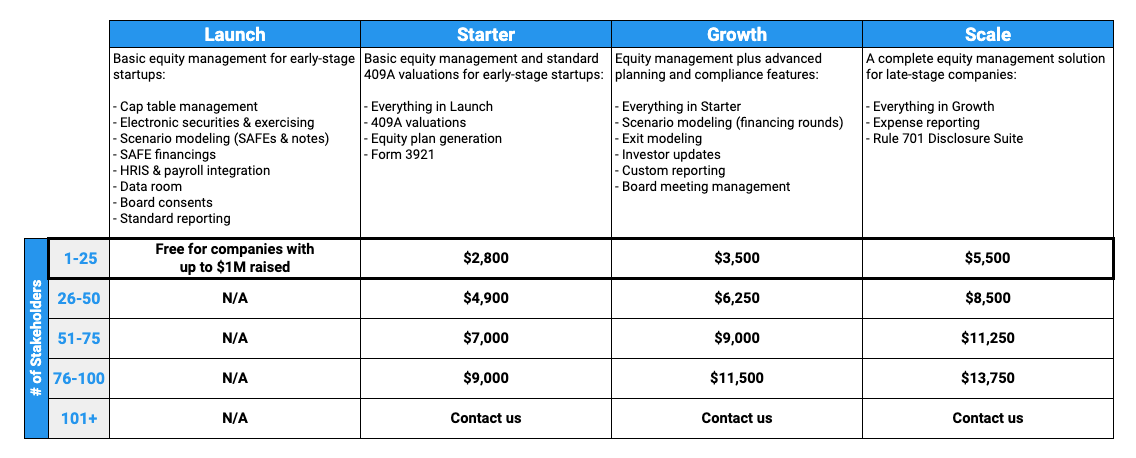

Current pricing

Always find Carta’s up-to-date new customer pricing on the Partner Resource Center (pw: partners).

Set up a Carta training for your firm

Carta’s Law Firm support team would be happy to host an engaging virtual product training for a group of paralegals and attorneys at your firm. Make sure your teams are up-to-date on how to use the Carta platform more efficiently. Please contact your Carta Representative or email us at partners@carta.com.

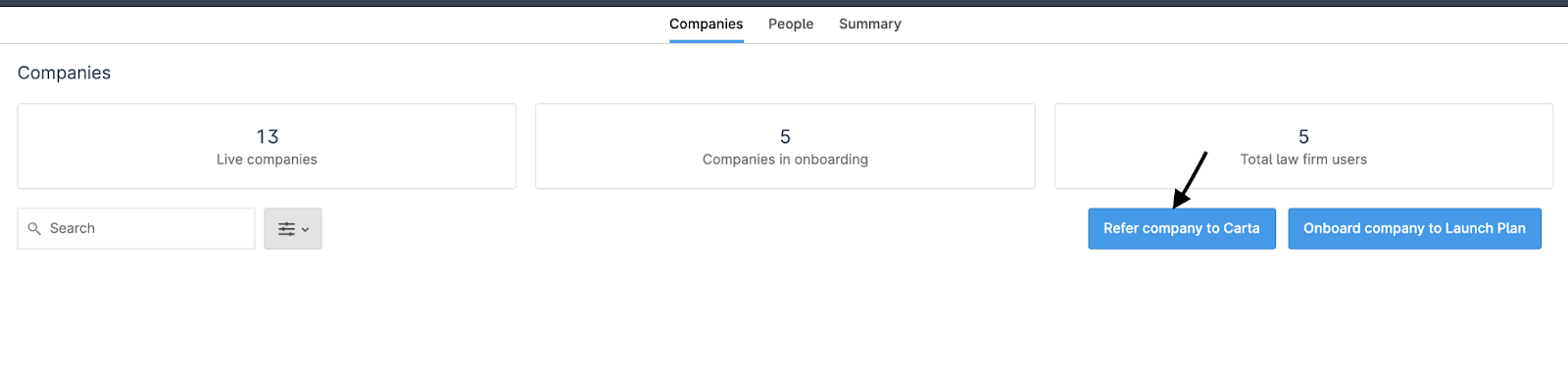

Partner Tier update & how to refer clients

Starting in April, you will receive monthly updates to track your firm’s referrals and any changes to your firm’s Partner Tier and associated partner discount. You can refer a client to Carta or add them to Launch directly from your Carta account. Referred clients receive your first-year partner discount on our paid plans.

Click on the adjacent image to access this.

Hot off the press

From the blog

How your clients can work best with you as their counsel, as well as Carta

We found a typical client’s costs are 2.5x higher if they include their counsel at the end of a Carta onboarding, rather than the beginning.

New podcast

The First Close podcast

Game-changing investors share their stories. Stream the Carta-produced podcast, The First Close on Apple Podcasts and Spotify.

At Carta, we help VCs build enduring venture franchises, starting with fund one. That’s why we’re excited to spotlight their journeys with our new podcast, The First Close.

New Youtube series

No Fear Equity: Startup Financing 101

In this new series from Carta, we break down some of the most complicated equity-related concepts in the startup universe, in simple terms that are easy to understand.

Webinar RECORDING

How to successfully raise SAFEs

Carta’s recent webinar covered best practices to consider, personal stories and lessons from two experienced founders, and Fenwick partner Morgan Sawchuk.

Webinar Recording

Getting ready for your first fundraise

Co-hosted by Carta, Stripe Atlas and Pilot, in this webinar we share how to access market data and best practices on fundraising.

WHERE TO FIND US