Carta edge for emerging managers

Start venturing with Carta Edge

The process of starting a venture capital firm is expensive, complex and unclear for fund managers. Carta Edge helps fund managers to focus on what you are most passionate about: investing. We guide you through fund setup, closing, and management.

Move faster with Carta Edge

The one-stop shop for launching a fund¹

Focus on investing

Carta's team takes care of formation and administration for your SPV or fund so you have more time to build your firm.

Get the guidance you need

Stop searching for operational support and reinventing the wheel. Carta offers playbooks and Pre-Close Services to guide you through forming your firm.

Be more efficient with Carta

No matter how you decide to build your firm, you can work with Carta for all your needs. Access our experienced fund administration team, easy-to-use platform, and network of trusted vendors.

Standard SPVs and funds

Get started now

Whether you’re starting out with SPVs or you’re ready to launch your first fund, Carta Edge is your partner. With Carta SPV and Carta Fund, we form the entities, provide legal document templates, administer your fund, send your LPs digital subscription documents, and provide tax and audit support.

Carta SPV

Streamlined, professional SPV

formations and administration

- Formation

- Carta Legal Document Templates²

- Closings

- Fund Administration

- Tax filings³

- Banking⁴

- Investor Portal

- Annual GAAP reporting

Carta Fund

Form and close your fund with

our seamless digital workflow

- Pre-Close Services

- Formation

- Carta Legal Document Templates²

- Closings

- Tax & audit support³

- Fund Administration

- Banking⁴

- Investor Portal

- Quarterly GAAP reporting

We also offer products and services ideal for funds in need of complex fund administration, capital call lines of credit⁵, ASC 820 valuations, portfolio insights, KYC/AML services and more.

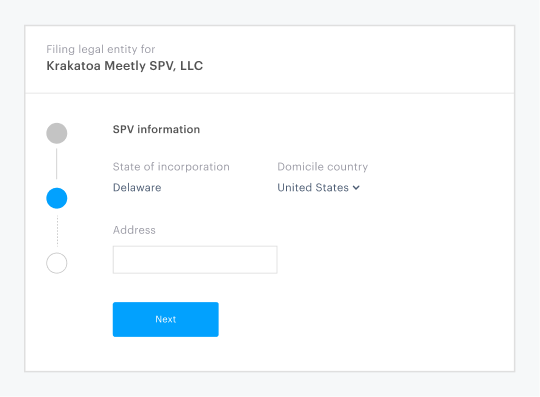

Simple, efficient SPVs

Carta SPV

We form the entity, secure a registered agent, and obtain a tax ID. Send your LPs digital subscription documents on Carta and manage your LPs with our robust platform. You can send your legal docs and manage accounting and taxes in-app, working with our experienced SPV and fund admin team and tax partners.

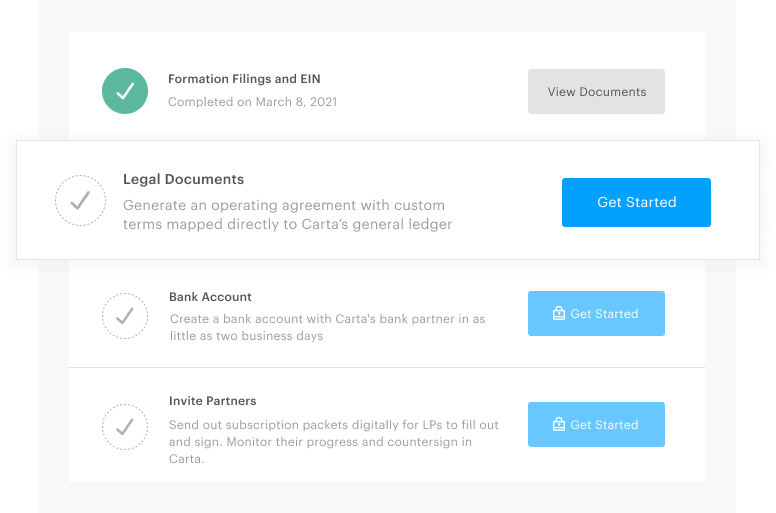

Fast fund formations

Carta Fund

Form your Delaware fund with just a few clicks and close your fund with our seamless in-app workflow. Pre-fill your subscription documents and leverage our industry-vetted Investor Questionnaire to streamline the process for your LPs.

Trusted advisory services

Pre-Close Services for funds

Leverage an expert from our Pre-Close Services team from start through your first close. We will guide you through the many decisions you make as you put together your first fund. Pre-Close Services is included with Carta Fund Formations.

Guidance for first-time fund Managers

A step-by-step guide to launch and manage your firm

From the blog

Key resources for first-time funds

IRR Calculator

How VC funds calculate their internal rate of return (IRR)

Data room

Build an effective data room

with 5 key documents

LPA Guide

Carta's definitive guide to

the LPA

VC Pitch deck template

How investors approach fundraising from LPs

The First Close podcast

The new voices of venture capital

Game-changing investors share the stories of their first venture capital funds. Stream The First Close on Apple Podcasts and Spotify.

Get updates from Carta Edge

- Carta does not provide legal or financial advice. We recommend that clients consult with legal, tax, and financial advisors.

- Carta’s legal documents are not intended to serve as legal or financial advice. We recommend that you consult with an attorney licensed in the relevant jurisdiction as well as tax and financial professionals.

- Tax return preparation and filing services are provided by a third party service provider.

- Banking services are provided by Coastal Community Bank, a Member, FDIC, or another banking partner.

- Carta offers capital call lines through a strategic partnership with Coastal Community Bank, a Member, FDIC (“Coastal”). If you are approved for a capital call line of credit (“CCL”), Coastal will be your lender. Coastal’s obligation to provide a CCL to you will be subject to customary conditions, including but not limited to Coastal’s satisfactory completion of due diligence on you, your GP and your LPs, there being no material adverse change in your business/financial condition, and final, executed loan documents.