CARTA investor services

Premier fund accounting meets tech-enabled platform

Carta’s investor services platform enables superior fund management. Let our team of experienced fund accountants streamline your back office. Access our full-service fund administration, LP management, ASC 820 valuations, capital call lines of credit¹, SPV formation and admin, quarterly or annual reporting, audit and tax support, and portfolio insights. All with a trusted, flexible, tech-forward platform that adapts to your firm.

Why choose Carta for fund management?

Experienced team

Our experienced team of 120+ fund administrators will partner with you to manage your back office and do all the heavy lifting. Whether you’re a first-time fund manager or a seasoned institutional firm with complex needs, we’ve got your back.

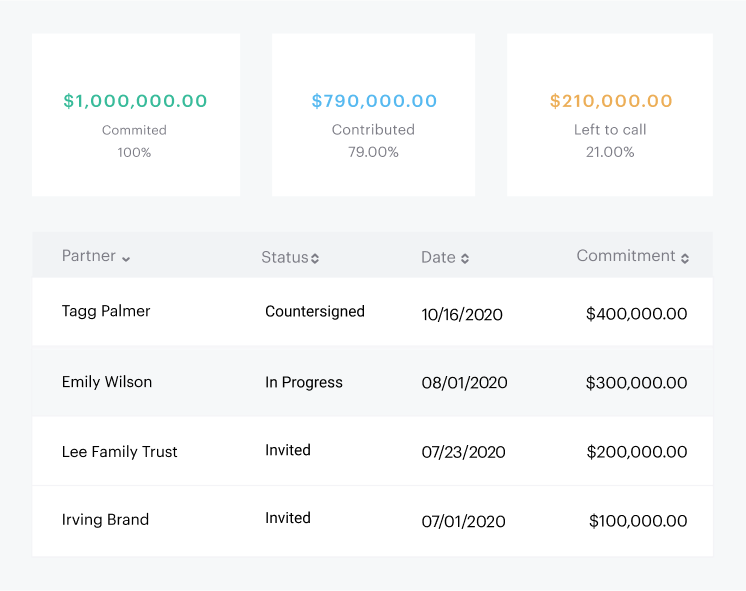

Superior LP experience

With our streamlined document subscription service, LP Portal, and robust reporting suite, you can onboard LPs, share documents and fund performance, track fund commitments, and issue capital calls easily. Thousands of LPs already use Carta.

Innovative platform

Our superior platform is supported by a team of forward-looking engineers who’ve built the Carta General Ledger and workflows that improve efficiency, minimize data discrepancies, and help you maximize returns. Our platform grows with you.

INVESTORS ON CARTA

Trusted by over 500 firms representing over $53B in assets under administration

INSTITUTIONAL INVESTORS ON CartaX

Optimize your portfolio with greater access to liquidity and disclosure

Investors in the CartaX network have the opportunity to expand their investment options, streamline their portfolio management, and make informed decisions with standardized disclosure and reporting sourced directly from the issuer.

Fund administration services

Full-service fund administration

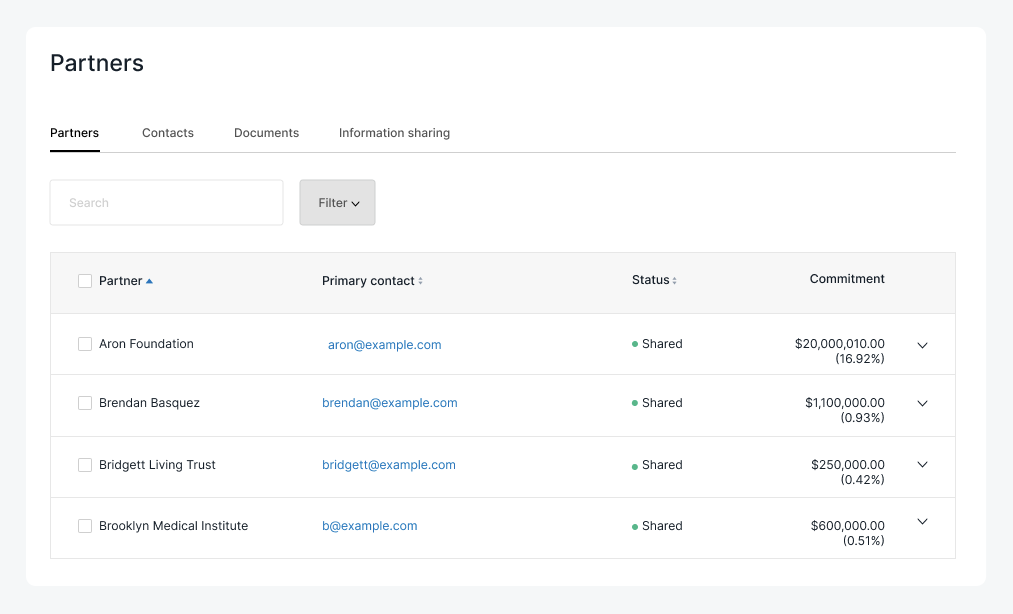

LP Portal

Easily communicate with your LPs

Enable your LPs to quickly and securely access documents and fund level performance data. LPs can view all their investments and key metrics in one place. Easily see active capital calls, access fund commitment information and active investments with streamlined LP management.

ASC 820 VALUATIONS

Get audit-ready ASC 820 valuations

Carta’s team of analysts have performed thousands of valuations. Our team leverages best-in-class technology for increased accuracy and fast delivery. If you prefer to run your own valuation, we also offer a self-service ASC 820 tool that will guide you step by step.

Portfolio insights

Evaluate investments all in one place

With Portfolio Insights, we’ll collect cap tables and key data from all of your portfolio companies. Easily model exit scenarios for more investments and let Carta handle your data collection so you can work on deals.

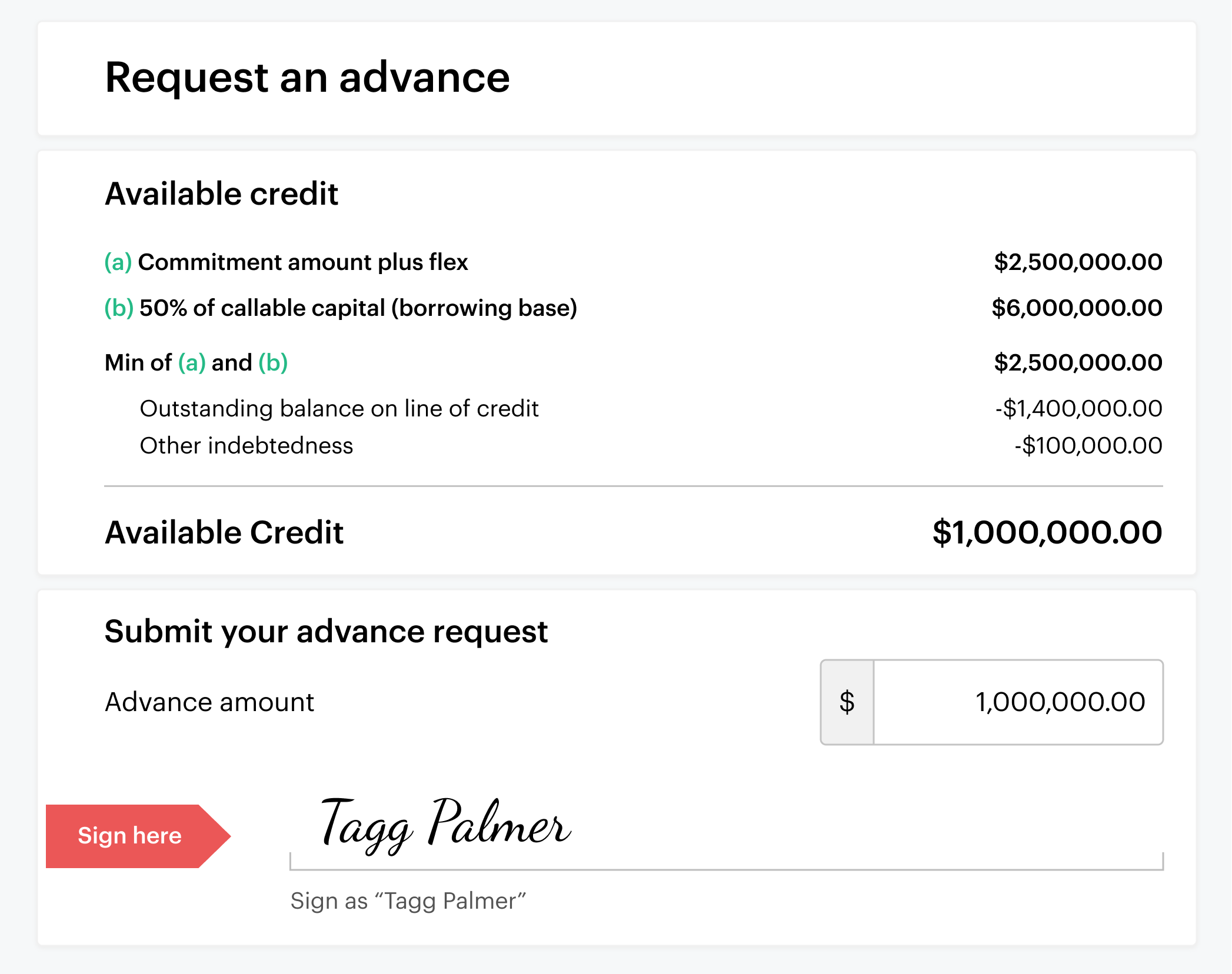

Capital call lines of credit (CCL)¹

Manage your liquidity more effectively

Call capital at a regular cadence and help your LPs plan for liquidity more effectively. Get approved quickly with the best offer available. Add a flexible tool to your toolkit for how you manage cash, call capital from LPs, and never miss an investment opportunity.

Special purpose vehicles

Form, onboard LPs, and administer your SPV with quickness and ease

Form your SPV with just a few clicks. Use our new subscription documents workflow to onboard investors with ease and fewer steps. Let our team manage your SPV and provide yearly reporting and audit support. Get off the ground quickly and we’ll take care of everything from start to finish.³

ACCESS PORTFOLIO COMPANY CAP TABLES

Real-time portfolio company data

When a portfolio company issues you a security on Carta, you can request access to its cap table. You’ll then see details like cash raised, last preferred valuation, and your ownership percentage. If you’re a Carta customer, you can use Carta’s waterfall and round modeling tools when companies grant you cap table access.

SCENARIO MODELING

Model term sheets more quickly

PARTNER PROGRAM

Carta partners with VCs and accelerators

join carta