Sometimes, companies offer stock as part of your employee compensation package. They usually issue incentive stock options (ISOs), non-qualified stock options (NSOs), or restricted stock units (RSUs). These mainly differ by how/when you have to pay taxes and whether you have to purchase the shares.

ISOs are a type of stock option that qualifies for special tax treatment. Unlike other types of options, you usually don’t have to pay taxes when you exercise (buy) ISOs. Plus, you may be able to pay a lower tax rate if you meet certain requirements.

With other types of options, like NSOs, you pay taxes both when you exercise and sell your options. This usually means you pay more taxes with NSOs than with ISOs.

Here’s everything you should know about ISOs:

What are stock options?

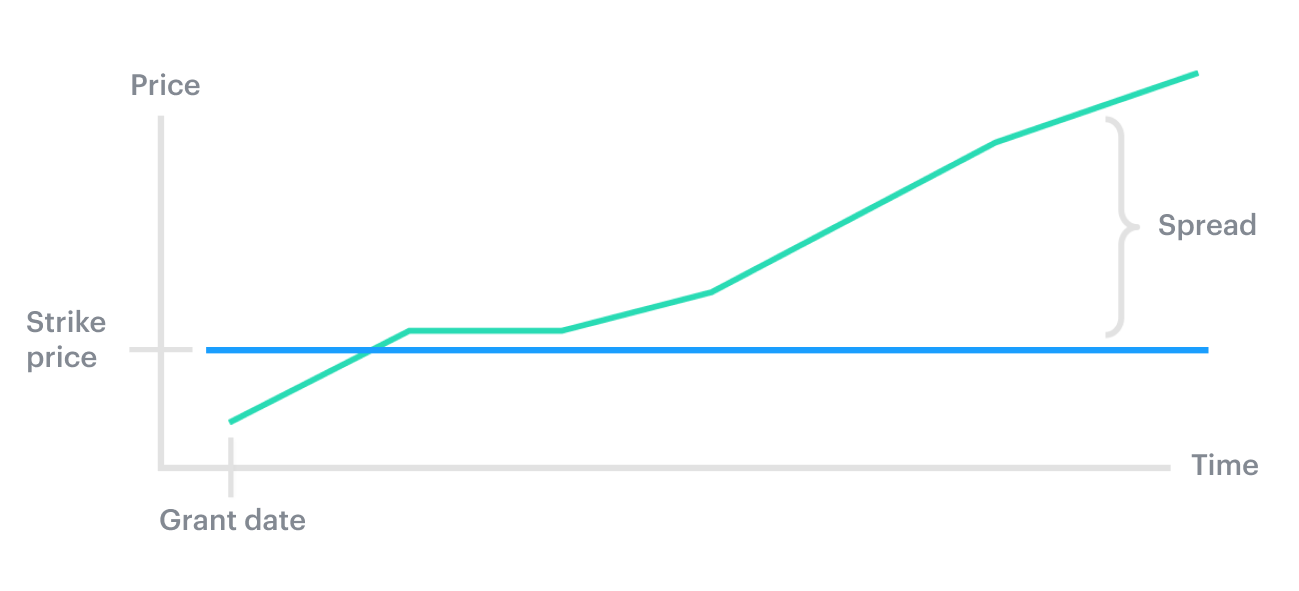

A stock option is the right to buy a set number of shares at a fixed price—usually the market value of the shares when they’re granted to you. This price is set by a 409A valuation and is often called your “strike price,” “grant price,” or “exercise price.”

If the value of the share increases over time, you can make money on the difference between your fixed purchase price and your eventual sale price, or “the spread.”

Stock options are often used as a way to attract talent and incentivize employees to stay with a company. If employees exercise (purchase) their options, they become shareholders in the company.

ISO vesting: When can I exercise?

Usually, you can’t buy all of your shares right away and have to work for the company over time to be able to purchase your shares. This is called vesting. You can exercise your stock as soon as your options have vested, but you’re never required to exercise.

In some cases, you might be able to exercise your options before they vest. You can check your option grant or ask your company to see if they allow early exercising. Note that this may result in a taxable event, so also consult with your tax advisor.

When do incentive stock options expire?

Theoretically, ISOs expire 10 years from the date you’re granted them. However, your company might enforce a post-termination exercise (PTE) period that gives you a shorter amount of time to exercise options after you leave the company. If you don’t exercise them before that period ends or before they expire, you’ll lose the opportunity to purchase them.

Even if your company gives you a long time to exercise ISOs after you leave, if you don’t exercise them within three months of leaving, they’ll lose their ISO tax treatment and will be taxed like NSOs.

When can I sell my shares?

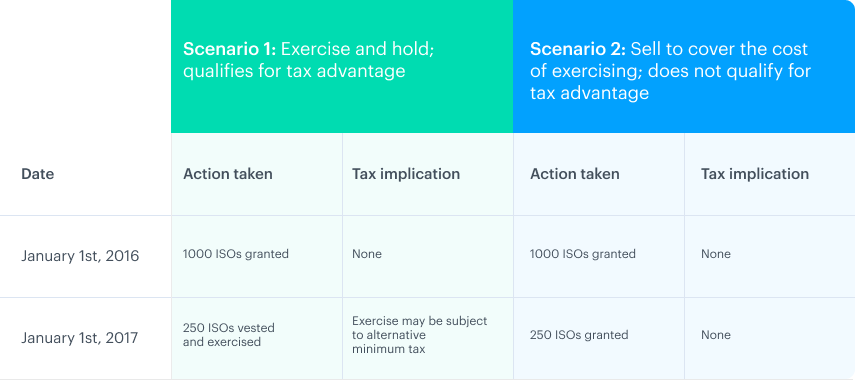

You have to exercise ISOs and purchase shares before you can sell your shares. If you choose to exercise, you usually have two options: pay for the total in cash or do a “same-day sale”—in other words, sell a portion of your shares to cover the cost of exercise.

Selling to cover exercise costs is called a “cashless” exercise. It’s less risky because you haven’t invested your own money. However, selling shares right after exercising prevents you from taking advantage of ISOs’ favorable tax structure. Not all companies allow cashless exercises, so check to see if yours does before exercising and check with your tax advisor in general.

How are incentive stock options taxed?

There are two types of tax to consider with equity compensation: ordinary income tax and capital gains tax. The capital gains tax rate has historically been lower than the ordinary income tax rate.

When you exercise ISOs, you don’t have to sell the resulting shares right away. If you do sell right away (for example, to cover the cost of exercise), the shares you sell won’t qualify for the ISO tax advantage. Instead, they’ll be taxed like NSOs and you’ll pay ordinary income tax on the spread between your strike price and the FMV at the time of sale.

If you exercise ISOs and hold your stock for at least one year, your stock should be eligible for the tax incentive when you sell. To receive the incentive, you must hold (keep) ISOs for at least one year after exercise and two years after the grant date.

- If you hold your stock for at least a year after purchase, you will pay the lower capital gains tax rate on the increase in value. However, you may be subject to the alternative minimum tax (AMT) when you exercise. Talk to your tax advisor to see if AMT might impact you. Typically, it only affects high-income earners.

- If you sell your stock right away, you will not experience any capital gain and therefore will pay ordinary income tax rates on the portion that you exercise and sell.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.