Why run a private tender offer?

Venture funding has increased substantially over the last five years, making it easier for companies to raise money and delay an IPO and exit. The appetite for liquidity alternatives is growing, and tender offers have become a popular mechanism. A private tender offer is an episodic event in which eligible sellers (as determined by the company and/or buyer) are able to sell shares for a minimum of 20 business days.

Tender offer benefits include:

- Providing founders, employees, and company investors with a way to sell a portion of their vested or owned equity for significant life events or to realize returns

- Allowing companies to recruit and retain high-quality talent in a competitive hiring landscape

- Providing outside investors with additional ownership without the dilutive effects of a primary financing

- Reducing the number of owners in a company

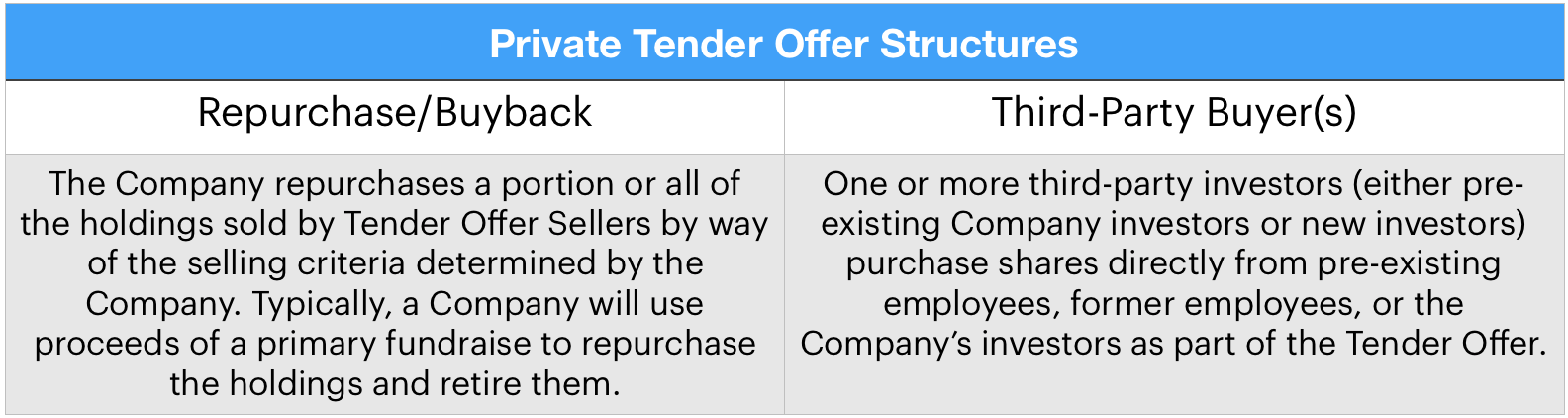

Tender offer structures

Before deciding how to structure a tender offer, companies need to be aware of how the tender will affect the participants from a tax perspective. Understanding the tax consequences of tender offers begins with understanding the relationship between the transaction price, the most recent 409A valuation, the buyer of the stock, and the frequency of the transactions.

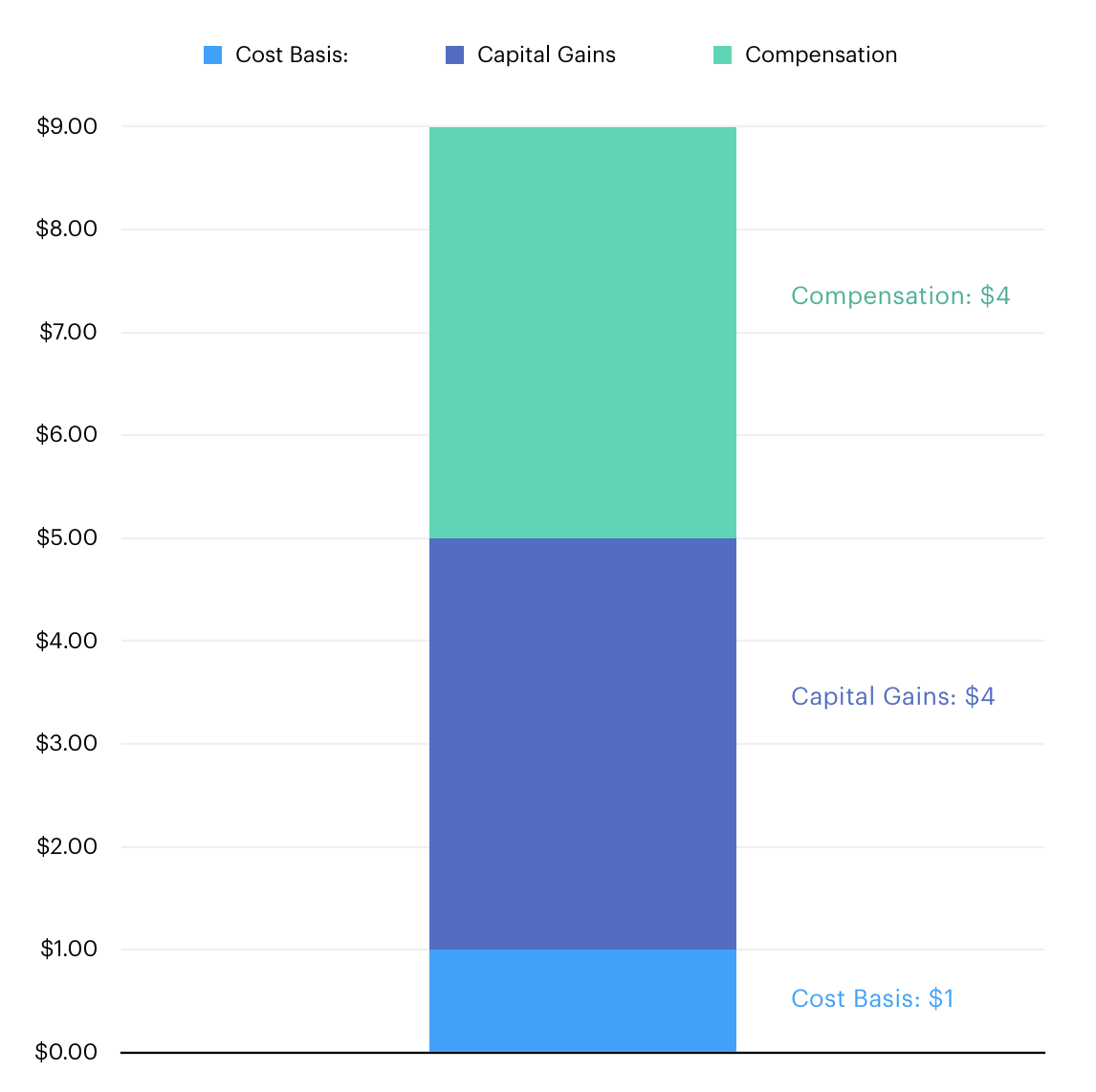

Depending on the aforementioned points, the proceeds from a liquidity transaction may be deemed as compensation paid by the company and require all or a portion of the proceeds to be reported as wages.

Tax implications: sellers and companies

The taxation and reporting of tender offers changes significantly when there is a compensatory transaction. In aggregate, the sellers will pay more taxes due to a portion of their income being treated as wages rather than capital gains. However, the increase in effective tax rate will change based on the type of equity being sold, the relationship between the sellers and the company, and the holding period of the stock.

The company’s tax considerations are also affected by compensatory tender offers. The company will be responsible for the employer portion of employment taxes on the income reported as wages, but the company would generally be entitled to a deduction for the amount reported to employees as income. This deduction could be valuable to the company depending on the size and usability of the losses.

Companies that report wages to employees are responsible for tax withholding where necessary. Carta makes money movement easy by depositing the necessary withholding amounts directly into the company’s bank account during the tender offer closing process.

How Carta helps

Carta provides clients with the ability to run structured liquidity programs. Our team of dedicated account managers assist companies of all sizes with the tender offer process through our platform.

Schedule a time to discuss

If you’d like to have a discussion about structuring a private tender offer or liquidity transaction for your team, or want the full white paper to better understand the tax consequences associated with tender offers, you can schedule time with our team here.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Please consult your attorney for legal advice, or your accountant for tax advice.