2019 is already proving to be a banner year for IPOs. Some of the biggest names in tech have recently gone public, and others still are preparing for their public debut. Yet as an employee of one of these companies you may not be sure what this means for you financially. If your company is going public in 2019, or even in 2020, here’s what you can do to be IPO-ready.

Step 1: Understand how equity works

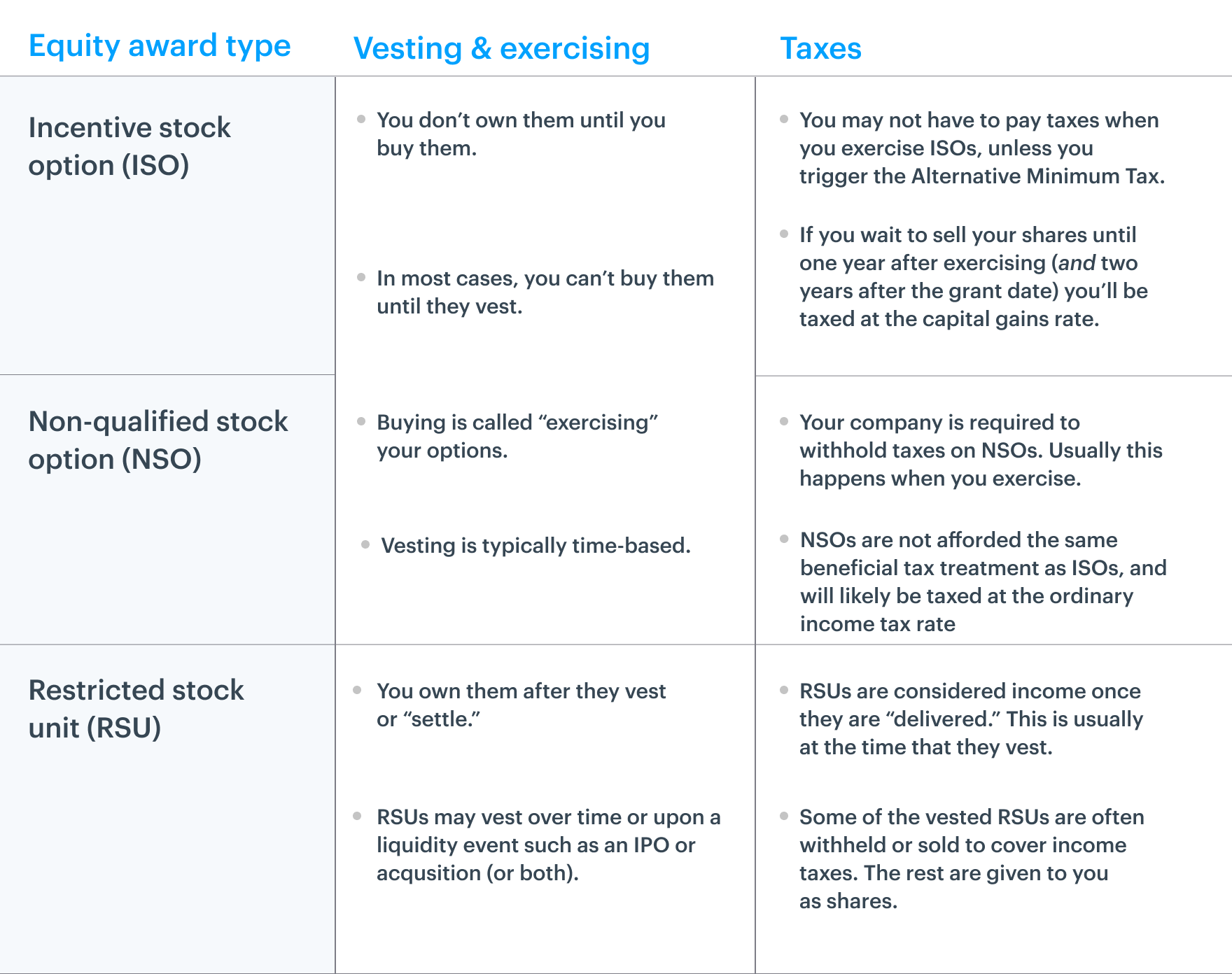

There are a few types of equity that are standard across most companies, all with confusing acronyms like ISO, NSO, and RSU. Every type of equity works differently, so step one is understanding your options (literally). Here’s a breakdown of the different equity types you might have.

Note that the following explanations only cover the most common cases, but the rules around vesting, exercising, and tax treatment may vary for you. Be sure to talk to a tax advisor to understand your individual situation.

To help you understand how these different types of equity might play out for you, here are a few typical scenarios:

ISOs and NSOs

Most often, ISOs will end up playing out the same way as NSOs. That is:

- You are granted your options when you start working at your company.

- You start vesting but do not exercise your vested options because it’s expensive to do so.

- After the IPO you exercise and sell on the same day, and make money on the increase in share price.

- You pay ordinary income tax on the money you made from selling.

Here’s the other way it could play out with ISOs only:

- You are granted your options when you start working at your company

- You start vesting and you exercise your vested options because you have the money to do so and you believe the value will go up.

- You sell after the IPO and make money on the increase in share price.

- Assuming this is at least one year since you exercised (and two years since your grant date), you could end up paying capital gains tax on the money you made from selling, which is usually a lower rate than ordinary income tax.

RSUs

With RSUs, under ordinary circumstances, it’s a bit simpler:

- You are granted your RSUs when you start working at your company

- Your RSUs start settling and you now own actual shares.

- You sell after the IPO and make money on the increase in share price.

- You pay ordinary income tax on the money you made from selling.

Keep reading to learn more about exercising and taxes.

Step 2: Decide when to exercise your options

One question you might have is, “Should I exercise my options before the IPO?” The short answer is: it depends. Specifically, it depends on whether you can afford to exercise your options now, and whether you want to hold onto your shares for a while or cash out right away.

Option 1: Wait until the IPO so you can exercise and sell on the same day

Unless you’re planning on holding onto your shares, it probably makes sense to exercise your options and sell at the same time, after the IPO. This is known as a “same-day sale.”

- Pros: The cash you make from the sale can go back to cover taxes and fees, so you’re cashing out right away and you know how much money you made immediately.

- Cons: If you have ISOs, you’ll miss out on a potential tax benefit (see below).

Option 2: Exercise now and sell after the IPO

One reason to consider exercising before you sell is if you have ISOs and you want to take advantage of the tax benefit from holding your shares.

- Pros: If you wait to sell until one year after exercising (and two years after the grant date) you’ll be taxed at the capital gains rate, which is typically lower than the ordinary income tax rate.

- Cons: In order to exercise a year before you sell, you have to have enough money in the bank to pay for your options and lock up those funds for a while. If you have a lot of equity, this option might be cost-prohibitive. You are also taking on the risk of any drop in value.

Option 3: Cash out pre-IPO (if your company will let you)

Some companies will offer employees liquidity before the IPO, through a tender offer or secondary program. If this is the case at your company, you can also consider this third option, which is to exercise and sell (or sell any already-exercised shares) before the IPO even happens.

- Pros: You know the price and exactly how much you’ll make, avoiding any potential loss in value at or after the IPO.

- Cons: You’ll miss out on the upside if the stock rises in value at or after the IPO.

Step 3: Prepare to sell

This is the step that employees are usually most excited (and most confused) about. This is the moment you’ve all been waiting for — so, when can you sell?

Find out if there’s a lockup period

You usually can’t sell your shares until a certain number of days after IPO, usually 180 days, unless it’s a direct listing (like Spotify’s IPO). This time is known as a “lockup period.”

Get your shares in a brokerage account

This is a piece that trips a lot of people up — before you can sell your shares you need to put them in a brokerage account. Most people don’t realize that shares are usually in book entry form at a transfer agent, and not automatically transferred to a brokerage account. Here’s what you’ll need to do:

- Set up your brokerage account. Your company might have a “captive broker” you are required to use, or they may give you the option to choose your own.

- While you’re setting up the account, be sure to complete and file a W-9 so you won’t be subject to backup withholding.

- Have a broker request your shares be delivered from the transfer agent to your personal account. Get the shares transferred at least a few days before the lockup period ends, so you can sell them as soon as you’re ready.

Do a practice run

Finally, you may want to do a practice run on how to trade shares through your equity compensation system so that you’re ready to go when the time comes to sell.

Step 4: Talk to a tax advisor

To get a comprehensive and personalized understanding of your taxes, it’s best to speak with a tax advisor. It may be helpful to find someone who also holds the Certified Equity Professional (CEP) designation — they’ll have a deep understanding of the tax consequences for all equity types.

You’ll want to ask your tax advisor about qualifying versus disqualifying disposition for your ISOs (this is legal-speak for the holding period mentioned above), the Alternative Minimum Tax, backup withholding, and any other tax implications they think are relevant.

This last step may be the most important, so you can enjoy your long-awaited windfall and not get hit with a big surprise come tax season.

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.