Anyone who’s ever worked in venture capital fund administration knows it’s a complicated job. You’ve got thousands of details to get right. You need to communicate with LPs, auditors, and colleagues, all on varying timelines. It takes time, tact, and a relentless focus on detail.

The prime directive of Carta’s investor services team is to make fund administration easier and less complicated. Recently, our product team has been working on three main focus areas:

- Streamlining the most time-consuming tasks

- Enhancing reporting accuracy

- Creating a smooth experience for GPs and LPs

Here’s a look back at what we’ve done to improve investor services in the last six months.

The closing experience, upgraded

Making closings easier was our most-requested improvement of 2022. Carta’s product team released updates that removed roadblocks and made the experience better for both LPs and GPs. Some highlights:

A new investor questionnaire

After some deep listening to legal teams, GPs, and LPs about their needs, we released a new version of the investor questionnaire in the closings tool. We went through it with an eagle eye to find ways to button up the language so that it’s clear and unambiguous throughout, updating references and definitions.

No more rigid spousal signature requirements

The earlier version of the questionnaire contained rigid requirements for all spouses to sign if the subscriber lived in a community property state. Now, the LP and GP have the flexibility to determine whether a spouse’s signature is required and give them instructions for how to add a spouse when it’s necessary.

A clearer picture for LPs and GPs

The closings tool now gives LPs and GPs a clearer picture of the questionnaire, before they need to sign. The new PDF viewer allows them to see it in any screen size, with new navigation that makes reviewing and signing the document much easier.

Smoother LP management for closings

We listened to fund administrators and LPs themselves to make several improvements to the closing experience:

Returning LPs

LPs who have already filled out documents on Carta now see their information pre-filled for new subscription documents. They can add any remaining information and sign their subscription docs with just a few clicks.

This is especially useful for LPs with investments on Carta both as an individual and through entities like trusts or LLCs. And fund managers launching multiple funds or SPVs with the same LP base can now offer a streamlined experience for their LPs.

Track each LP’s status

You can now easily see the status of each LP in the closings tool—knowing at an instant what each LP needs to do to progress and sign.

Withdrawing LP signatures

If an LP needs to change any information they entered before the fund countersigns, you can withdraw their signature right from the closings tool. When you do, you’ll automatically notify the LP to let them know that they can make changes before re-signing.

Add LPs in batches by yourself

No more adding LPs one by one—now, you can bulk-add and manage your LPs through the closings tool. Take a look at our walkthrough when you’re ready to add your next batch of LPs.

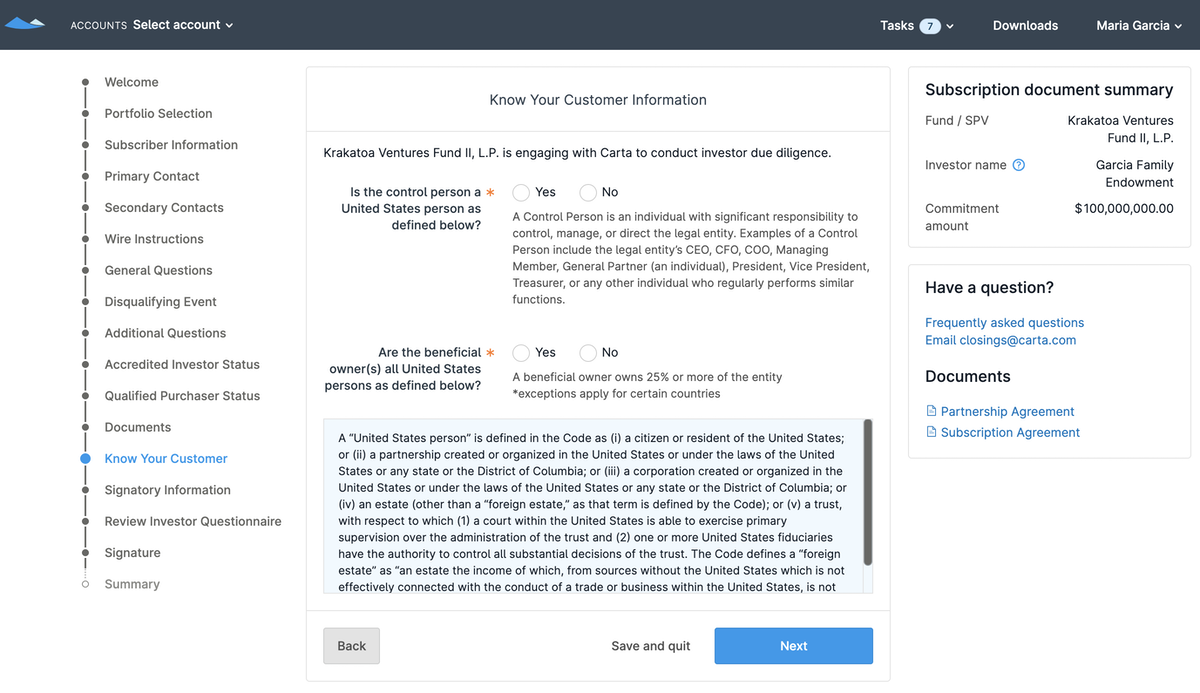

Instant KYC for non-individual LPs

We’ve had the ability to perform our instant KYC for individual LPs for a while: With this service, LPs are KYC’d on the platform as soon as they sign subscription documents. Now, you can instantly KYC non-individual LPs who complete subscription documents, as well. We use Carta integrations with identity and leading industry-standard verification databases.

If one of your funds uses Carta’s KYC/AML service and closings, Carta instantly KYCs the LP’s control person and beneficial owner(s) as well as the LP entity itself. (Right now, instant KYC is only available for U.S.-based LPs.)

See LPs’ tax documents before countersigning

If you review your LPs’ tax documents as a standard part of your review and countersign process, now you can look at W-9 and W-8 forms in the countersignature and check them against the other information the LP has submitted. Before now, you could only see those documents after the countersignature.

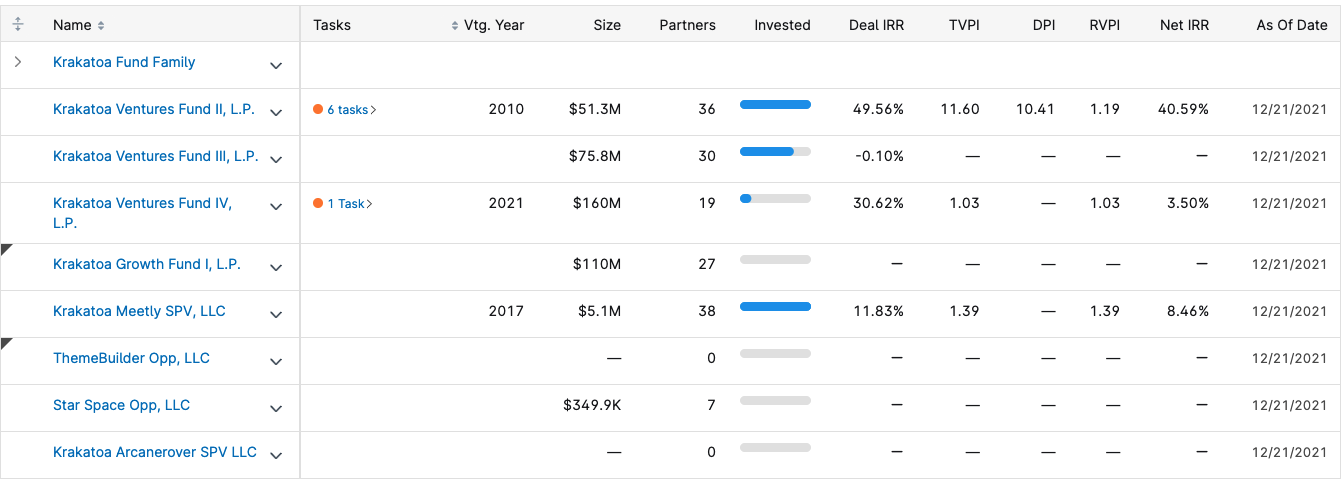

A new, simplified firm management page for GPs

Fund admin GPs can now get a cohesive look at your funds and their performance from your dashboard, without having to click around to find what you need. Instead of landing on the firm overview page when logging in, you’ll see this new homepage.

Now, you can:

- See high-level metrics for all of your entries at a glance

- Access fund detail pages (including fund performance, partners, and investments)

- Search for and navigate to any of your entities

- Filter and sort your entities

This is the first of several new features we’ll be implementing to simplify the GP experience on the platform. Stay tuned for more in 2022. (Note: There won’t be any difference to the LP experience with this update.)

Upgrades to the schedule of investments

Better quarterly reporting with the Fund of Funds section

We’ve broken out Fund of Fund investments into a separate section in the SOI. Now you can see fund investments separated and sub-totaled—which will help you make your quarterly and annual report presentations more informative and easier to understand.

Categorize your documents, right in the SOI

Knowing what documents you have—and more importantly, which ones are missing—is critical. This update helps you stay on top of documentation by letting you categorize documents within the asset drilldown in your schedule of investments.

If you have documents that are tied to assets, just click on an asset, categorize the files that are there, then upload and categorize those that aren’t. Where we expect documents to be signed by applicable parties, you can specify if they are “executed” or not. (PSA: Remember to open the document and confirm that they’re signed by the client and the counterparts.)

A few other improvements for fund admins

All LP documents, in one place

Your LPs no longer have to click into each of their funds to see their documents. We’ve brought together all of an LP’s documents—across funds—under the “documents” tab in the sidebar.

Once inside the document center, LPs can

- View documents for any funds for which they have accepted their commitment

- Accept their commitment to funds if they haven’t done so yet (they’ll be asked to consent to electronic delivery of documents)

- Bulk-download documents

- Search and sort by sender (by fund), by date, and by document type

See a 10,000-foot view of your LPs

Do you ever need to see details about LPs across all of their commitments in the firm? Now, you can:

- See an overview of each LP to look at their total commitment, NAV, capital called, outstanding balance, and other information across all of their commitments in the firm.

- Manage LP contact info across multiple funds

- See all partner documents that have been shared with LPs—and upload and share LP documents for multiple funds at one time

Firm permissions get more flexible

Managing permissions for all the various users on your accounts can be complicated. We’ve made updates to our permissions management so that larger firms can get more granular, while keeping them easy to manage for emerging managers.

Fund admin clients on Carta now have the ability to grant users on their accounts access to only the information they need. They can choose to grant access to investments, limited partner information, fund administration, and fund performance data.

Admins can also save themselves steps by setting default access to each firm. Setting up a default will automatically give users the same permissions for each new fund that gets added to the account.

Permissions are controlled under the settings on a firm account. Non-admins can go to the settings page to see who the admin on their account is and ask for permissions changes if needed. You can learn more about updating permissions in this support article.

| Permission | Grant access to |

| Admin |

|

| Investments |

|

| Partners |

|

| Fund Admin |

|

| Fund Performance |

|

| Audit |

|

Save time during audits

Auditors who have been granted access to a fund can now view and download bank statements directly. It’s a small feature, but it saves a lot of time that used to be spent downloading and sharing statements with auditors. We have a handful of other improvements planned for early 2022 to improve the auditor experience—including improved permissions to other relevant pages and exports, and bulk-downloading bank statements.

A quick reminder: Auditors can be added to the people page and granted the auditor permission.

A more efficient SPV experience

Finally, we’ve moved creation of the SPV formation engagement letter to within the Carta application. The engagement letter is the contract that clients sign to begin the process of forming an SPV with Carta. This update removes the need for duplicate entry. It’s the first step in a series of improvements we’re making to automate SPV formations. You can start out the SPV process with Carta here.

What improvements to fund administration would you like to see in 2022? We’re always listening. You can reach out to us with suggestions. And if you’re not yet a customer, let’s talk about how Carta can help you save time, improve LP communications, and stay on top of your documentation.