Exercising stock options and taxes

Let’s explore what it means to exercise stock options, the taxes you may need to pay, and the common times people exercise their options.

We’ll cover four topics in this post:

1. Two types of stock option taxes to keep in mind

2. ISO tax treatment and benefits

3. Required ISO holding periods to receive tax benefits

4. Common times people exercise stock options

Ordinary income tax vs. capital gains tax

There are two types of taxes you need to keep in mind when exercising options: ordinary income tax and capital gains tax.

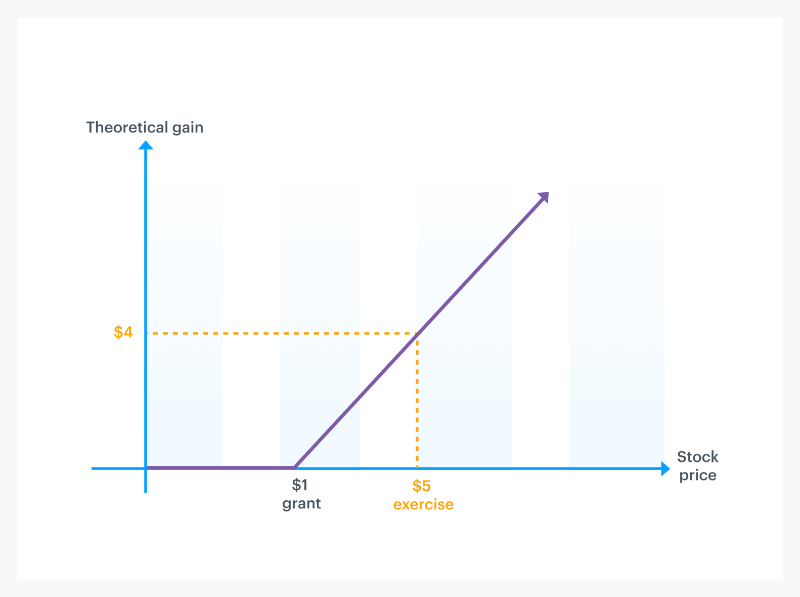

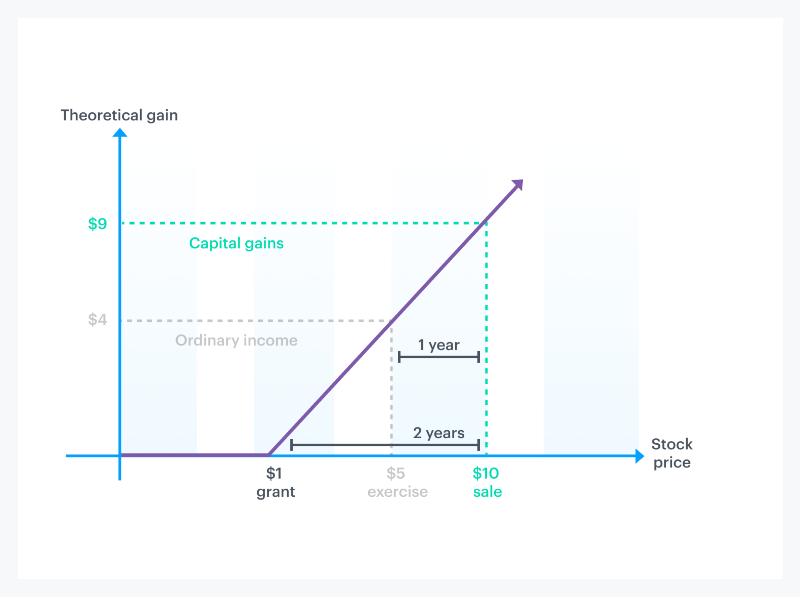

In our continuing example, your theoretical gain is zero when the stock price is $1 or lower—because your strike price is $1, you would pay $1 to get $1 in return. As the stock price grows higher than $1, your option payout increases.

If you decide to exercise when the stock price is $5, your theoretical gain is $4 per share. That’s the $5 stock price minus your $1 strike price:

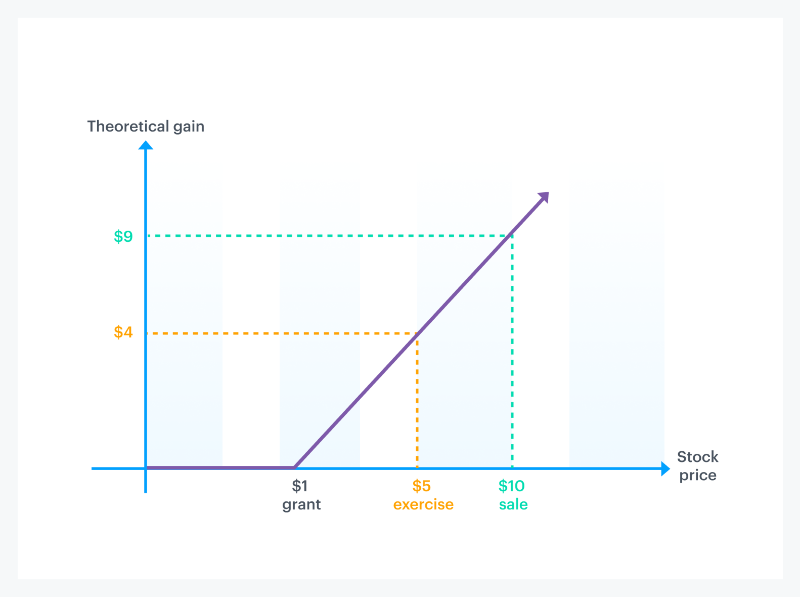

If you sell the stock when the stock price is $10, your theoretical gain is $9 per share—the $10 stock price minus your $1 strike price:

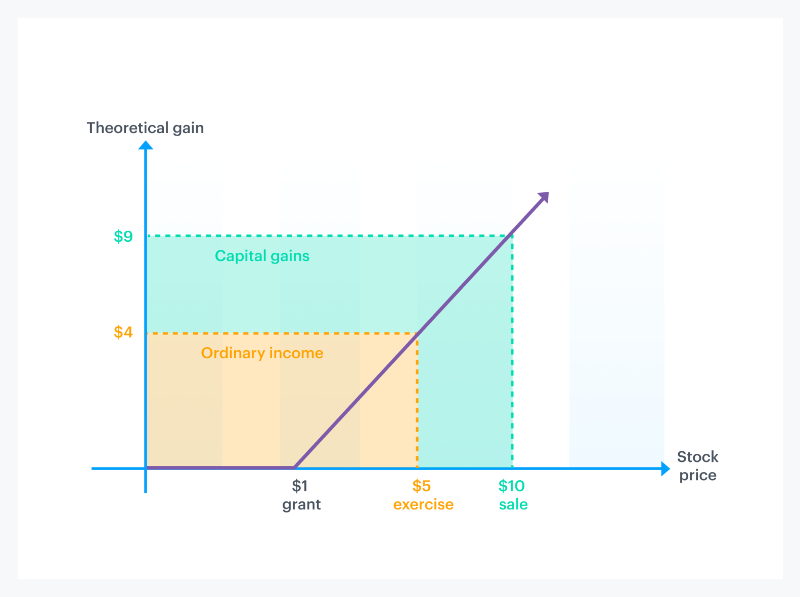

The spread (the difference between the stock price when you exercised and your strike price) will be taxed as ordinary income. Because Meetly (our example company) let you buy the stock for $1 at a time when the fair market value had risen to $5, it’s almost like they paid you that $4 difference, along with your income and salary.

You’ll pay capital gains tax on any increase between the stock price when you sell and the stock price when you exercised. In this example, you’d pay capital gains tax on $5 per share (the $10 sale price minus $5, which was the price of the stock when you exercised). Because you own the stock at this point, any gain you make when you sell is a profit from selling the asset.

The ordinary income tax rate is currently almost double the capital gains tax rate, so optimizing your exercise strategy to maximize the benefits of long term capital gains tax treatment will result in lower tax liabilities. In other words, the smaller the gap between your strike price and the stock price when you exercise, the more you could benefit from capital gain tax treatment.

Now that you know the benefits of capital gains tax in comparison to ordinary income tax, it’s easier to understand the tax benefits of having ISO options (as opposed to NSO options).

ISO and NSO tax treatment

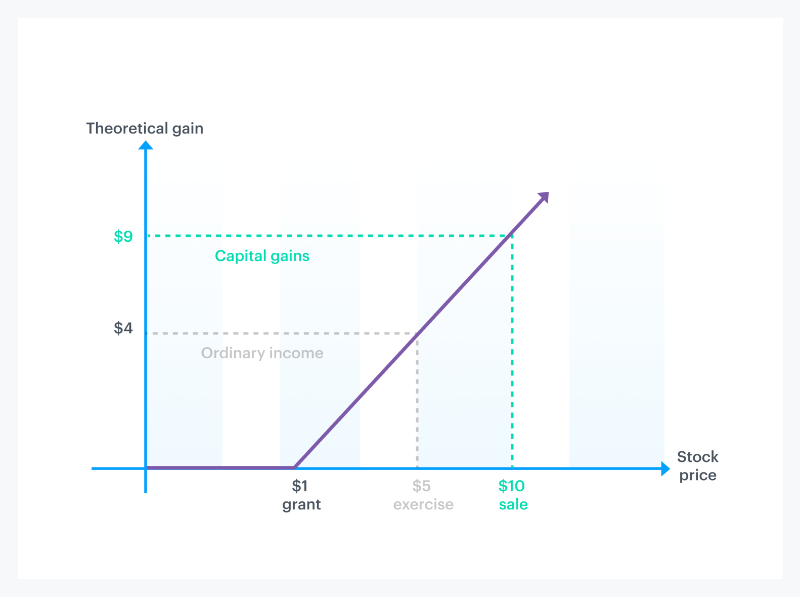

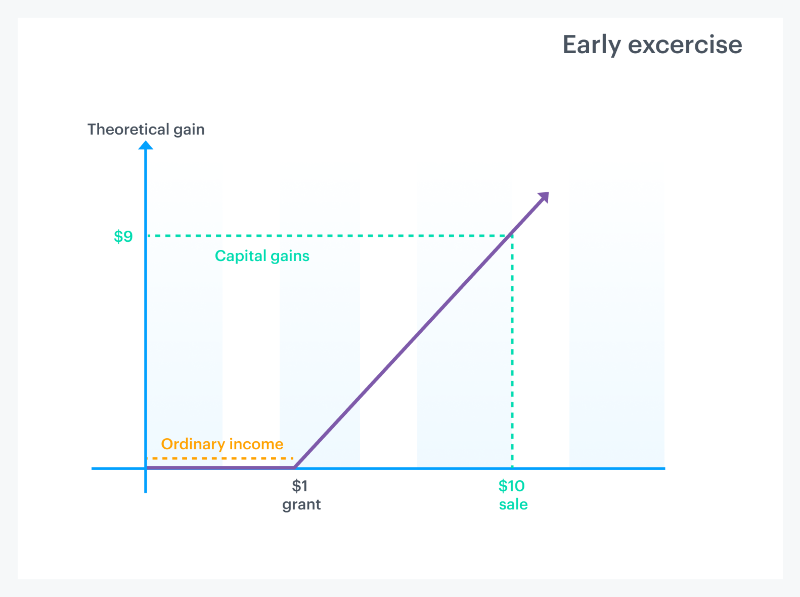

The tax benefit of ISOs is that you may not have to pay ordinary income tax when you exercise them. Instead, you may only have to pay the lower capital gains tax if you exercise them within—and hold them for—a certain amount of time. This contradicts the graph we just saw above, which actually shows the NSO tax treatment.

To visualize this, let’s return to the graph for an NSO exercise. With ISOs, ordinary income tax goes away.

If you hold ISOs and meet the holding periods, the entire $9 difference will be taxed as capital gains and you do not have to pay that tax until you sell the stock.

Alternative minimum tax (AMT) explained

That said, there is one other type of tax you should know about if you exercise ISOs and don’t sell your shares within the same year: the alternative minimum tax (AMT). AMT is a different way of calculating your tax obligation. It counts more things as taxable income—including the spread between the price you paid to exercise ISOs and their fair market value when you exercised. If you make more than the AMT exemption amount, you need to calculate your tax obligation both ways and pay the greater of the two calculations.

AMT can potentially reach thousands of dollars depending on your income and the difference between your strike price and the FMV of the stock when you exercise. Talk to a tax professional to learn how to plan for your AMT liability.

Holding periods

In order to take advantage of the ISO tax benefit, you need to meet certain holding periods. Specifically, you must hold (keep) ISOs for at least one year after exercising and two years after your options were granted.

If either of these holdings periods is not met (for example, if you participate in a tender offer and decide to exercise and sell in one transaction), the difference between your strike price and the sale price of shares will be taxed as ordinary income. You’ll still maintain the benefit of not paying this tax until you sell the stock, though.

It’s also important to note that you must exercise your ISOs within 90 days of leaving your company to retain the tax treatment of ISOs. Otherwise, they’ll be taxed as if they were issued as NSOs. This applies even if your company gives you more than 90 days to exercise after leaving.

Exercising stock options

To finish, we’ll cover some common times startup employees decide to exercise their options.

Termination

Many employees don’t exercise their stock options until they leave (or start thinking of leaving) their company. As discussed in Part 1, most companies require you to exercise your vested stock options within a set window of time after leaving the company. This window, called a post-termination exercise (PTE) period, is usually around 90 days.

Before you vest (early exercising)

Another common type of exercise is what’s known as an “early exercise.” Some companies’ equity plans allow this, and it just means you can exercise your options before they have vested—right after you accept the option grant, for example.

As you can see in the graph above, the benefit of doing this is that you are minimizing the pre-exercise gain. This could potentially limit your exposure to AMT. The downside here that you are taking on risk. There is no guarantee that your stock will ever be liquid, so you are paying to buy stock that could one day be worthless.

Form 83(b)

If you choose to exercise options early, you must file an 83(b) election to take advantage of the beneficial tax treatment. You only have 30 days to file this with the IRS, and there are no exceptions.

IPOs and acquisitions

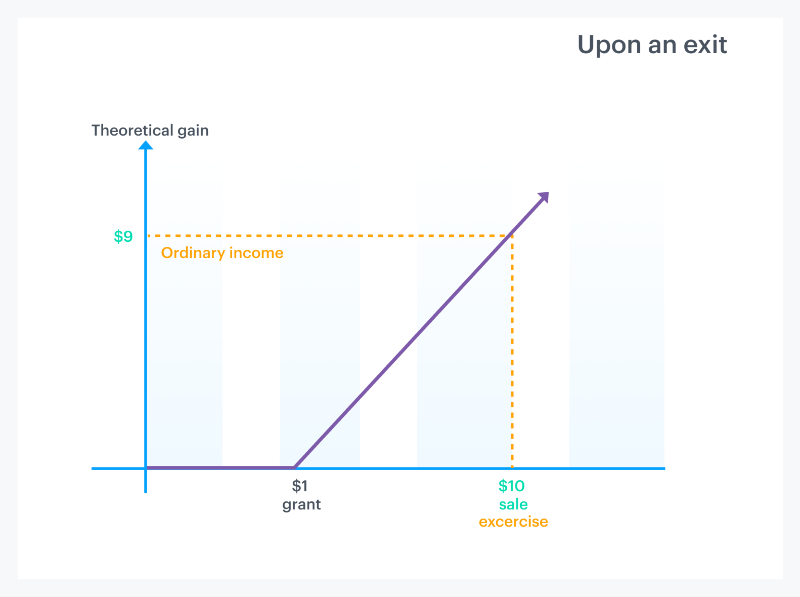

The third common time to exercise your stock options is upon an exit, such as an IPO or acquisition.

This is the least risky time to exercise because you know the stock is liquid. You can turn around and sell the stock for a gain (hopefully) the same day you pay to buy it.

The downside in this situation is that you usually end up paying more taxes. Remember: If you want to qualify for favorable tax treatment, you need to hold your ISOs for at least one year after exercising. That holding period won’t be met if you sell the stock on the same day you buy it. If this happens, your options will be treated like NSOs, and any spread between your strike price and the stock price when you exercise is taxed as ordinary income.

Here’s a quick recap:

- The two types of taxation to keep in mind when exercising your options are ordinary income tax and capital gains tax.

- We detailed the tax benefits of having ISOs: you do not pay tax on the day you exercise.

- We described the holding period (two years from the grant date, one year from the exercise date) that needs to be met to receive ISO tax benefits.

- We explained the three common times people exercise their options.

Help your employees navigate tax decisions

Carta Tax Advisory helps employees make informed decisions about their equity and taxes—powered by Carta’s cap table platform. Learn how you can help educate your team.

Further reading

Startup employee stock options

Carta employee resource center

How to value your equity offer (free startup equity calculator)

Employee Shareholder Bill of Rights

What does exercising stock options mean?

What happens to equity when a company is acquired?

Special thanks to Zibbie Nwokah for writing the first version of this article.

DISCLOSURE: This publication contains general information only and eShares, Inc. dba Carta, Inc. (“Carta”) is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.