Employers often offer stock options as part of your overall compensation package. This benefits both you and them—when you own a piece of the company, it motivates you to help the company do well. And sometimes, your stock options could end up being more valuable than your salary (especially if you join a company early and it takes off).

Stock options aren’t actual shares—they’re the opportunity to exercise (purchase) a certain amount of company shares at an agreed-upon price, called your grant, strike, or exercise price.

The hope is you get to sell your purchased shares for more than you paid for them. However, you’re never required to exercise—that’s why they’re called options.

How stock options work: granting and vesting

Grants are how your company awards stock options. Your grant will give you all the details of your equity plan, including:

- The type(s) of stock options you get

- How many shares you get

- Your strike price (cost to purchase the shares, usually based on the fair market value of the stock at the time of your grant)

- Your vesting schedule (when you’re allowed to exercise your shares)

The process of earning the right to exercise your options is called vesting. Usually, you have to pass the “vesting cliff”—when companies make you stay for a certain amount of time (usually at least a year)—before you can exercise any options.

You can usually only exercise vested stock options—if you leave your company, your unvested options will go back into the company’s option pool after your company’s post-termination exercise period ends. Some companies let you exercise options early, though, which can have certain tax advantages depending on your situation.

What are the different types of stock options?

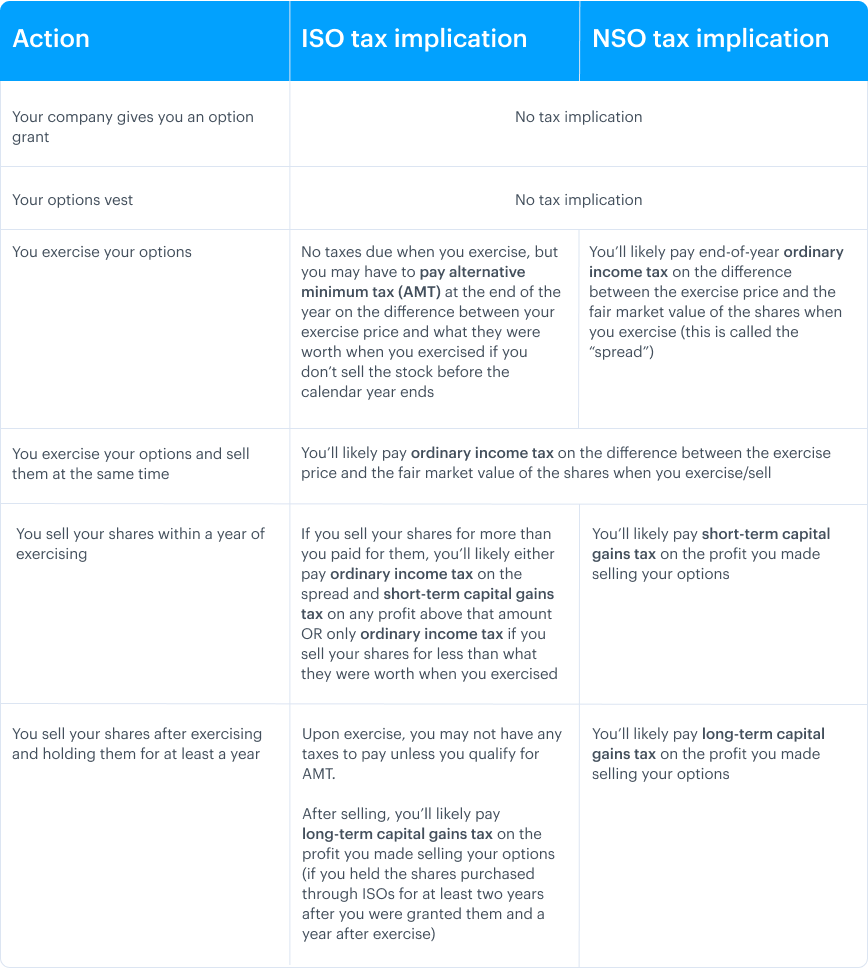

There are two main types of stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). These mainly differ by how and when they’re taxed (see How are stock options taxed below).

With NSOs, you usually have to pay taxes both when you exercise and sell. ISOs qualify for special tax treatment if you hold onto your shares for the required amount of time (at least one year after exercising and two years after your grant date), and you may only have to pay taxes when you sell your shares. However, you could have to pay AMT if you don’t sell your shares in the same year you exercise them.

Do companies offer other types of stock?

Sometimes, companies offer restricted stock instead of stock options. The two most common types are restricted stock units (RSUs) and restricted stock awards (RSAs).

An RSU is a promise from your employer to give you shares of the company’s stock in the future if certain restrictions are met. An RSA is like an RSU, except with RSAs you purchase the shares on the day they’re granted.

Should I exercise my stock options?

There are lots of factors to think about when deciding whether to exercise your stock options. It’s best to talk to a tax advisor so they can help you figure out if and when you should exercise. But in the meantime, you can ask yourself these questions about exercising stock.

How are stock options taxed?

Your tax obligation can depend on what kind of stock options you have, how much they’re worth, and when you exercise and sell. In general, here’s what you might be able to expect:

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is not to be construed as legal, financial or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.