Traditionally, investment banks are at the heart of the initial public offering (IPO) process, producing research reports and marketing a company to drive up demand ahead of its listing. Banks also act as underwriters, meaning they assess the financial risk of a company and help market shares to interested institutional investors. But there are signs that tech companies are increasingly forgoing the standard IPO process in favor of a Direct Public Offering (also known as a direct listing). Spotify surprised the market by doing a direct listing in 2018 and was one of the largest companies since Ben & Jerry’s to ever do so. Slack1 is the latest company to follow this trend.

What is a direct listing?

In an IPO, underwriters purchase shares from the company and sell them to investors through their distribution channels, raising new money for the company. In a direct listing, existing shareholders (employees and investors) are able to sell their outstanding shares on the open market or a secondary private market leading up to the initial day of trading on a public exchange, but no new capital is raised for the company.

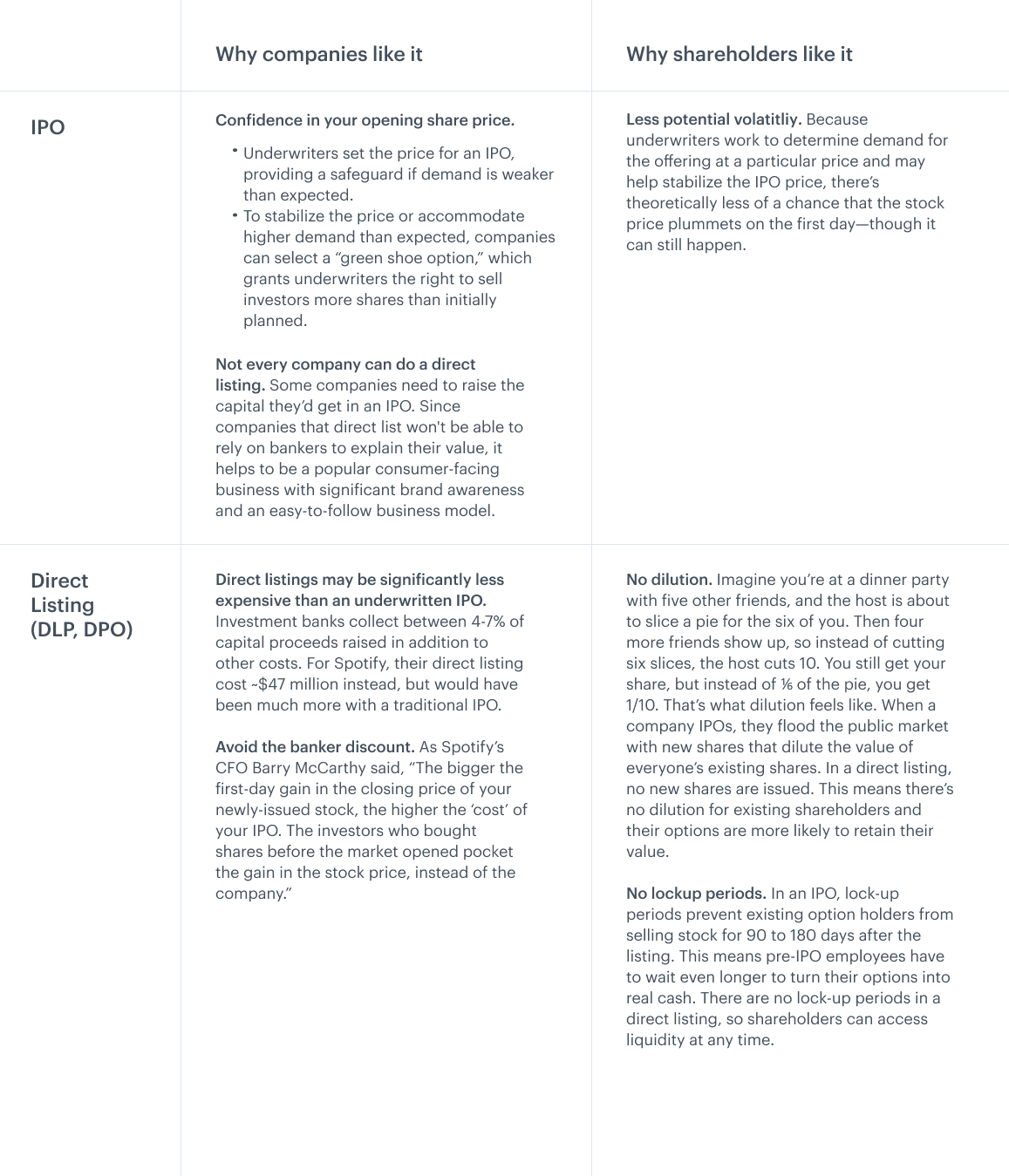

Here’s a basic breakdown of what companies and employees like about each option:

Unprecedented access to late-stage capital may be driving demand for this alternative path. Although 2019 has been called an IPO boom, we’re actually in a period of historically low numbers of IPOs. Private companies have plenty of options for venture capital and are staying private longer. Meaning, investors and early employees have to wait to turn their options into wealth. Direct listings give companies a way to provide liquidity to all shareholders without diluting everyone’s shares and making them less valuable—or spending a ton of money on underwriters.

Because Spotify’s stock has been relatively stable following its direct listing last year, companies like Airbnb are also considering following suit. Some, like TransferWise, are opting for big secondary rounds that provide liquidity opportunities to early investors and insiders. This can remove some of the pressure to pursue an IPO or direct listing. Although not all companies are able to support a secondary round, doing so enables shareholders to sell some amount of stock without dealing with public markets at all.

1 Slack founder and CEO Stewart Butterfield is an investor in Carta.

DISCLAIMER: Any opinions, analyses, and conclusions or recommendations expressed in this article are those of the author(s) alone and do not necessarily reflect the views of eShares, Inc. dba Carta, Inc. (“Carta”) and they may not have been reviewed, approved, or otherwise endorsed by Carta. This article is not intended as a substitute for professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor.