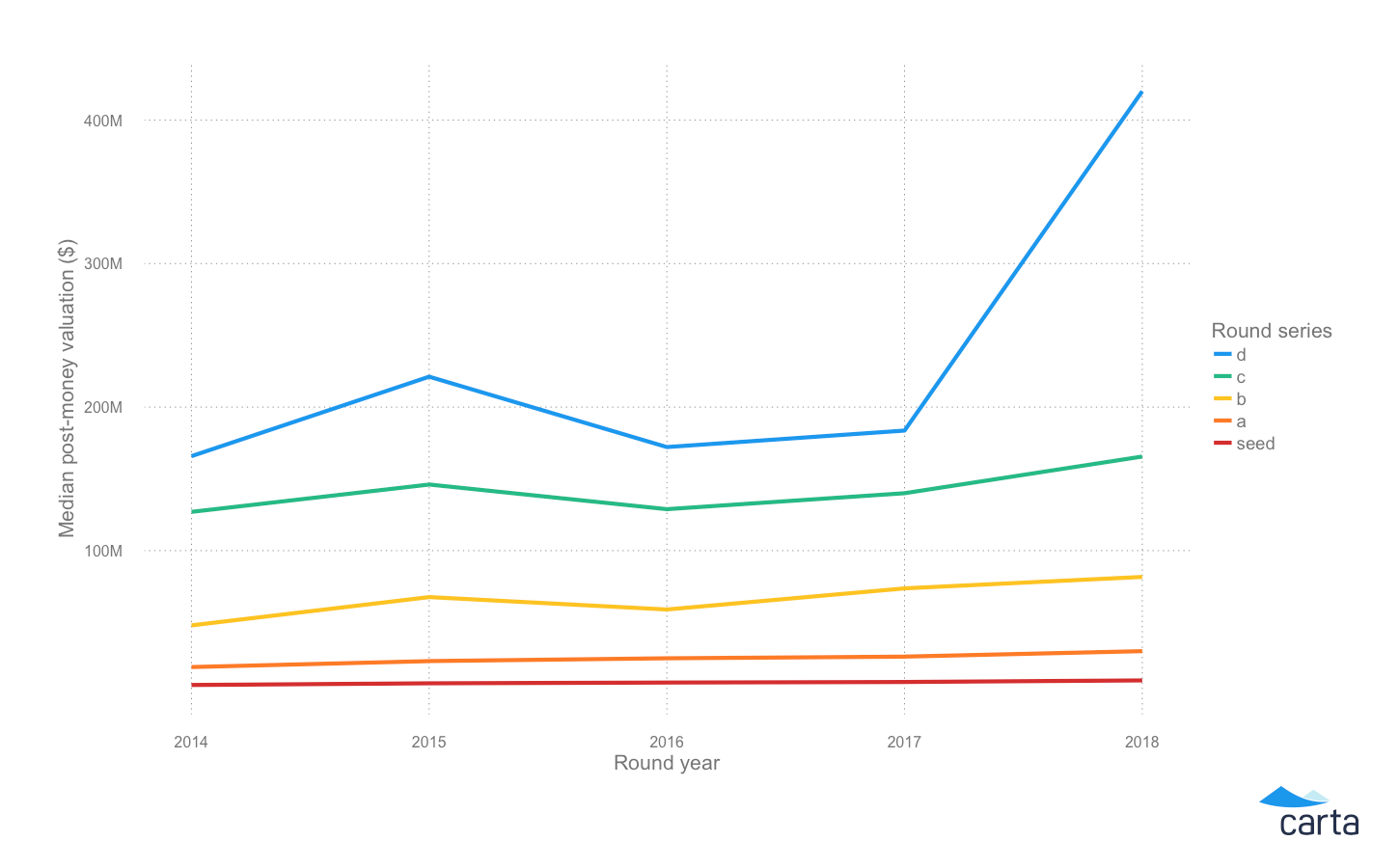

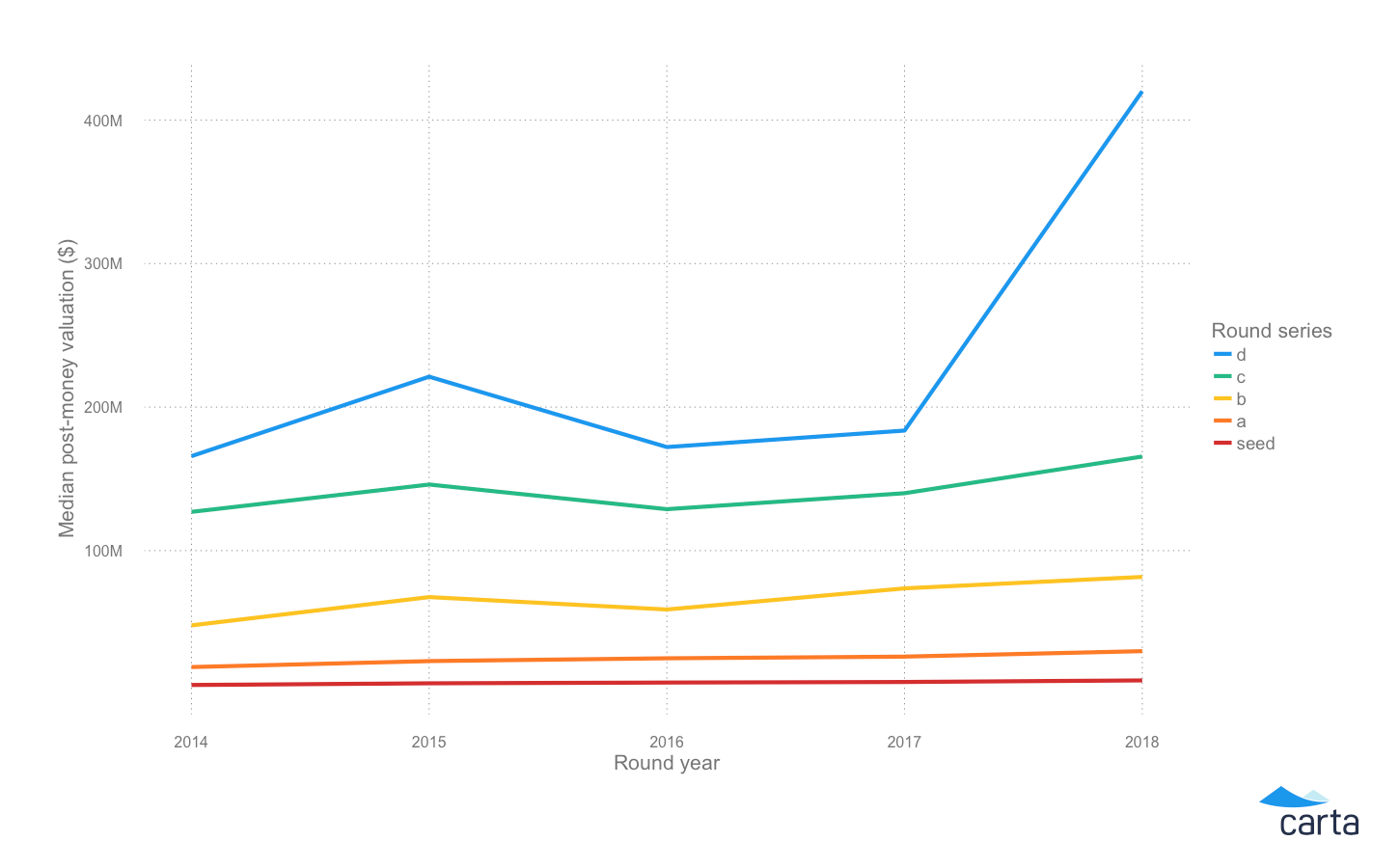

The state of private company financing in 2018

With increased access to capital, companies find staying private longer increasingly attractive. We decided to take a look behind these headlines and dig into the data.

With increased access to capital, companies find staying private longer increasingly attractive. We decided to take a look behind these headlines and dig into the data.

ASC 718 is the standard way companies expense employee stock-based compensation on an income statement. Equity awards are part of compensation and have a specific set of accounting rules, stated in ASC 718, that companies should follow.

Watch our recent webinar covering common questions like “what is a 409A valuation?” and “how should common stock value compare with preferred stock value?”

Much has been said about the gender pay gap, but most publicly available research focuses on only one part of compensation: salary. But in startups, wealth is created through equity ownership on the cap table.

Learn more about Rule 701, recent updates, and how to stay compliant at your company. Everything from the history of Rule 701 to the most recent changes.

We believe that in the near future, the most successful companies will be able to stay private, and going public will be a less common path.

Cap tables are a necessary evil for every startup founder, CEO or CFO. Excel spreadsheets are usually riddled with mistakes. Carta is changing that.

Private tender offers are a popular option for private companies to offer early employees and investors liquidity. Do you understand their tax implications?

Hiring and maintaining talent at a startup is hard. With the anonymous data Carta collects, we’ve demystified employee tenure and turnover trends.

eShares, Inc. DBA Carta, Inc. is registered with the U.S. Securities and Exchange Commission. The services and information described in this communication are provided to you “as is” and “as available” without warranties of any kind, expressed, implied or otherwise, including but not limited to all warranties of merchantability, fitness for a particular purpose, or non-infringement. Neither eShares, Inc. DBA Carta, Inc. nor any of its affiliates will be liable for any damages, including without limitation direct, indirect, special, punitive or consequential damages, caused in any way or arising from the use of the services or reliance upon the information provided in this communication or in connection with any failure of performance, error, omission, interruption, defect, delay in operation or transmission, computer virus or line or system failure. Carta Securities LLC is a broker-dealer and a member of FINRA and SIPC. Contact: eShares, Inc. DBA Carta, Inc., 333 Bush Street, Floor 23, Ste. 2300, San Francisco, CA 94104.