Why do private companies run liquidity events?

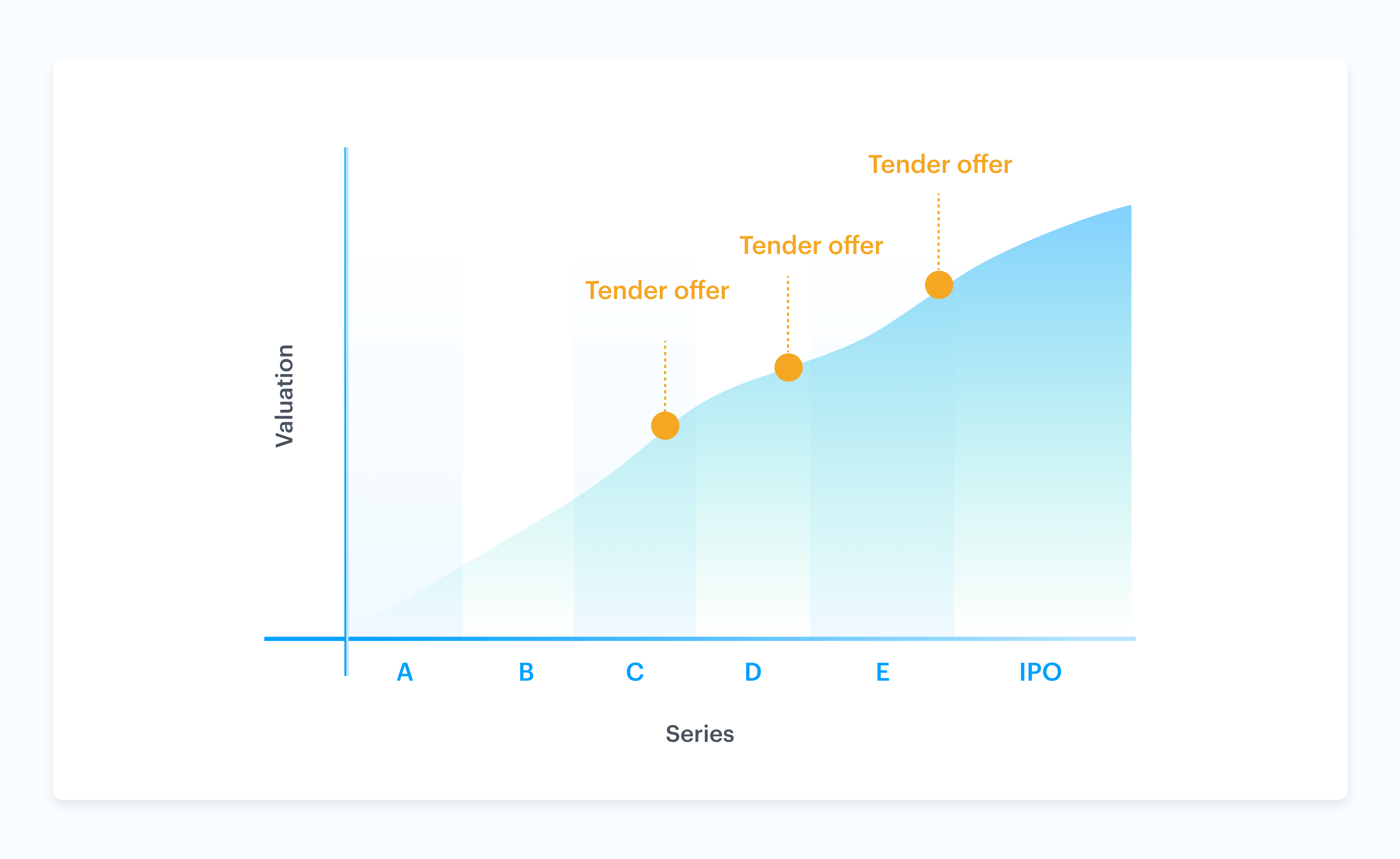

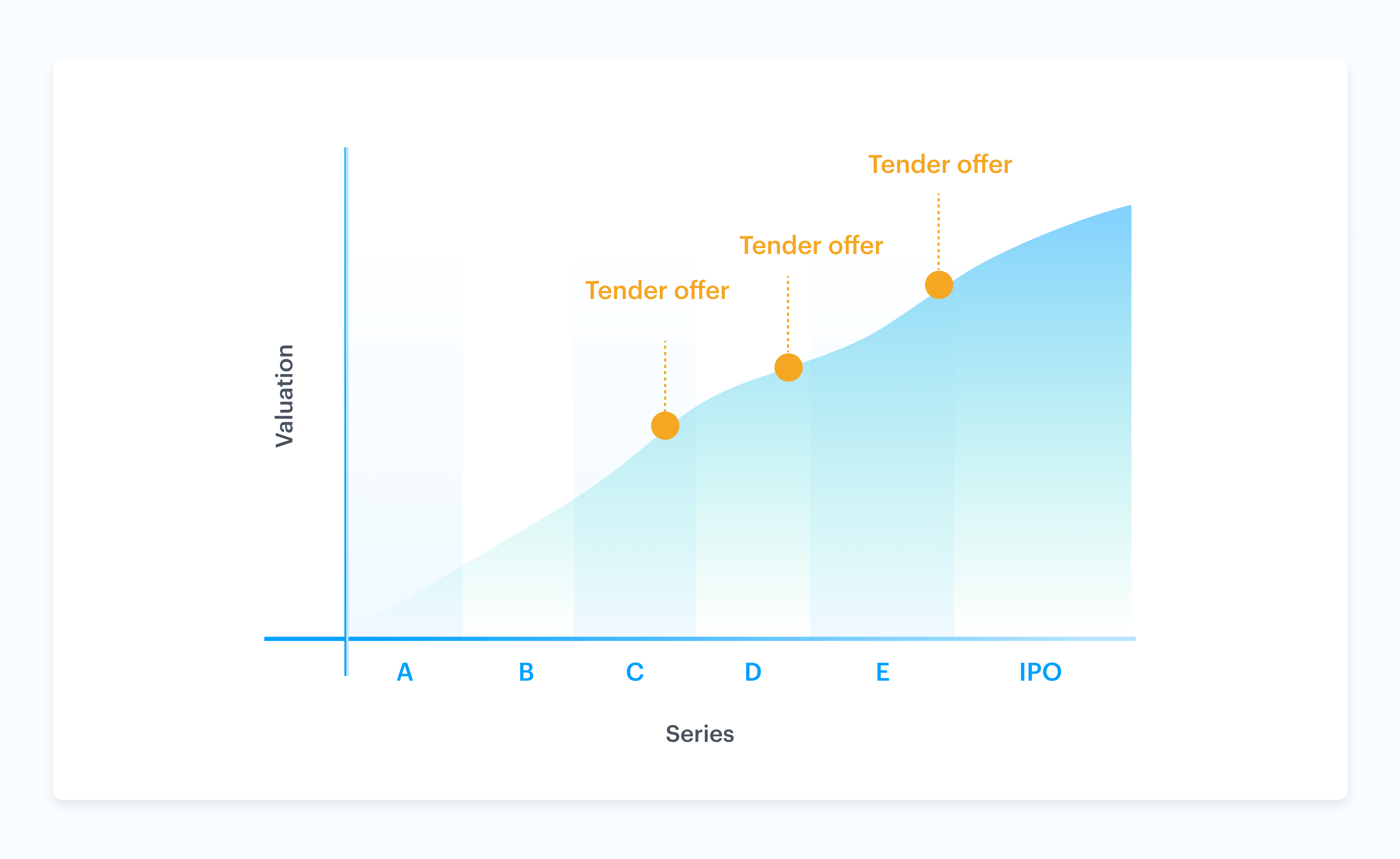

A tender offer is a structured, company-sponsored liquidity event. Tender offers can be company share-buybacks or third-party investor purchases.

A tender offer is a structured, company-sponsored liquidity event. Tender offers can be company share-buybacks or third-party investor purchases.

Founders and CFOs: here’s what you need to do before raising your next round and how Carta can help.

Stock options aren’t actual shares—they’re the opportunity to exercise (purchase) a certain amount of company shares at an agreed-upon price. Learn more.

Watch our webinar on fund compliance, common compliance mistakes, and regulatory changes.

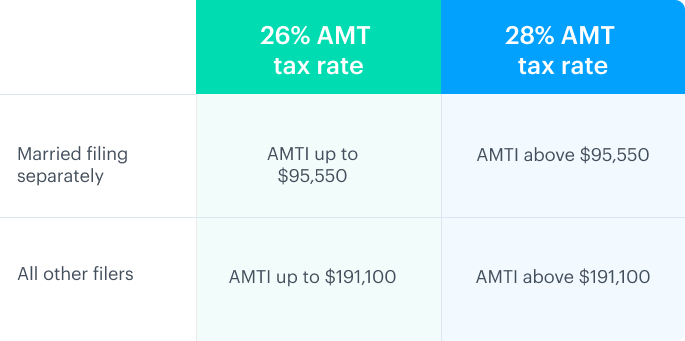

The alternative minimum tax (AMT) is a different way of calculating your tax obligation. Learn if you’re more prone to paying it, how to calculate it, how you may be able to minimize it, and more.

ISOs are a type of stock option that qualifies for special tax treatment. Unlike other types of options, you usually don’t have to pay taxes when you exercise (buy) ISOs. Plus, you may be able to pay a lower tax rate if you meet certain requirements. Here’s what you need to know.

In a direct listing, shares are released directly from existing shareholders (employees and investors) to whoever wants to buy them. Learn why some private companies might explore a direct listing instead of an IPO.

2019 is already proving to be a banner year for IPOs. Some of the biggest names in tech have recently gone public, and others still are preparing for their public debut. Yet as an employee of one of these companies you may not be sure what this means for you financially. If your company is going public in 2019, or even in 2020, here’s what you can do to be IPO-ready.

There’s a ton of advice out there for startup founders on how to raise money, set up business infrastructure, and track performance in the early stages of a company’s life. But there’s not as much guidance for managers of new venture funds.

eShares, Inc. DBA Carta, Inc. is registered with the U.S. Securities and Exchange Commission. The services and information described in this communication are provided to you “as is” and “as available” without warranties of any kind, expressed, implied or otherwise, including but not limited to all warranties of merchantability, fitness for a particular purpose, or non-infringement. Neither eShares, Inc. DBA Carta, Inc. nor any of its affiliates will be liable for any damages, including without limitation direct, indirect, special, punitive or consequential damages, caused in any way or arising from the use of the services or reliance upon the information provided in this communication or in connection with any failure of performance, error, omission, interruption, defect, delay in operation or transmission, computer virus or line or system failure. Carta Securities LLC is a broker-dealer and a member of FINRA and SIPC. Contact: eShares, Inc. DBA Carta, Inc., 333 Bush Street, Floor 23, Ste. 2300, San Francisco, CA 94104.