Within a matter of weeks, COVID-19 has disrupted companies’ 2020 operating plans and strategies. Venture investors are advising their portfolio companies to become as capital efficient as possible to endure the next 18 to 24 months.

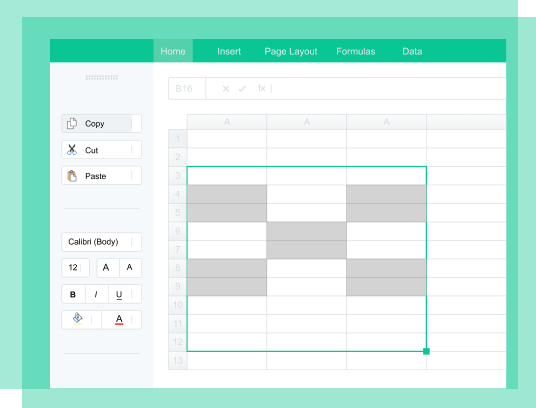

While every company operates differently, here are some things you need to think about when managing cash in a downturn. We also created a burn rate calculator to help you model your own cash runway.

Increase runway

The main purpose of increasing your runway is to provide optionality for your business and create an opportunity to identify avenues toward growth. Venture-backed startups expect their runway to last until they raise their next round of funding, an assumption that will be stress-tested in this new reality. Those rounds may no longer happen, or at the very least are likely to be delayed.

To plan for the future, identify key economic uncertainties that could impact your business over the coming year, then conduct scenario planning to determine the best, middle, and worst case for your business. Use the scenarios to back into a business plan, product roadmap, headcount target, revenue goals, and runway for each case. Then, choose the most likely scenario and associated operating plan. Communicate the new go-forward plan clearly to your investors and employees. Leadership during these times is about keeping your team focused on an achievable plan they understand and are bought into.

Improve capital efficiency

To achieve capital efficiency, it’s important to lower your burn rate without significantly slowing business growth. Start by reviewing your discretionary spending—items that can be easily cut or reduced, such as travel, marketing spend, software, external consulting, and meals/snacks. If you’re able, try to renegotiate fixed expenses like rent and vendor contracts. Also, identify opportunities to defer large payments, like the government tax relief for businesses and the employer portion of the Social Security taxes on employee wages. In the burn rate calculator below, we have line items for each of these expenditures so you can see the levers to pull to extend your cash runway.

Next, review your payroll and headcount projections. Payroll is the largest line item in most budgets, and for each employee you can assume a percentage load factor that includes benefits, rent, office supplies, equipment, food, and software. As a result, managing your headcount is often the quickest way to get your burn rate under control.

There are a few options to lower your payroll costs. Start by freezing hiring and merit increases. It’s much easier to not increase salaries and forgo hiring candidates than it is to lay off existing employees. However, while these steps may help you survive a short-term downturn, they may not contribute enough cash savings to get you through a prolonged recession. Layoffs are painful for all involved: employees impacted, employees remaining, and the company itself. You should only consider them when you’ve determined your company needs to take significant steps to reduce burn. Make a thoughtful decision so you can avoid multiple rounds of layoffs, and make sure you understand how the current environment impacts each individual team. For more on this, see our CEO Henry’s post.

Protect your business

Above all else, don’t delay. It can be very tempting to defer making decisions until you’re certain you need to act. But waiting too long to make hard decisions only decreases your company’s likelihood of survival, especially in a prolonged economic contraction. It’s important to act quickly both to protect your business in the long run and ensure you’re able to continue serving your customers.

Take a look at our burn rate calculator to model your expected runway.

Download the calculator

Key terms explained

- Cash runway: number of months you can operate your business with your current cash balance.

- Burn rate: the rate at which the company is spending cash; i.e. spending subtracted from revenue (billings). Generally calculated on a monthly basis, this is essentially the decrease in your cash balance on a monthly basis.

- Expenses: classified in two major buckets: cost of goods sold (COGS) and operating expense (OpEx). COGS = sum of the costs that directly support the delivery of your revenue streams, like infrastructure, technical and customer support, or implementation services. OpEx = sum of expenses incurred in the course of “ordinary” activities like product development, sales, marketing, G&A.

- Working capital: current assets minus current liabilities. Current assets include cash, accounts receivable, and short-term investments. Current liabilities are accounts payable, accrued expenses/wages, and deferred revenue.

- Accounts receivable: money due to your company for goods/services you’ve already delivered. Listed as a current asset on the balance sheet.

- Accounts payable: amount you owe creditors/suppliers. Listed as a current liability on the balance sheet.

Special thanks to Erin Kim for her help writing this post and building the calculator.

DISCLOSURE: This publication contains general information only and eShares, Inc. dba Carta, Inc. (“Carta”) is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.